- Qatar

- /

- Capital Markets

- /

- DSM:IHGS

If You Had Bought Islamic Holding Group (Q.P.S.C) (DSM:IHGS) Stock Five Years Ago, You'd Be Sitting On A 88% Loss, Today

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Islamic Holding Group (Q.P.S.C) (DSM:IHGS) during the five years that saw its share price drop a whopping 88%. And it's not just long term holders hurting, because the stock is down 46% in the last year. Furthermore, it's down 27% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 15% in the same period.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Islamic Holding Group (Q.P.S.C)

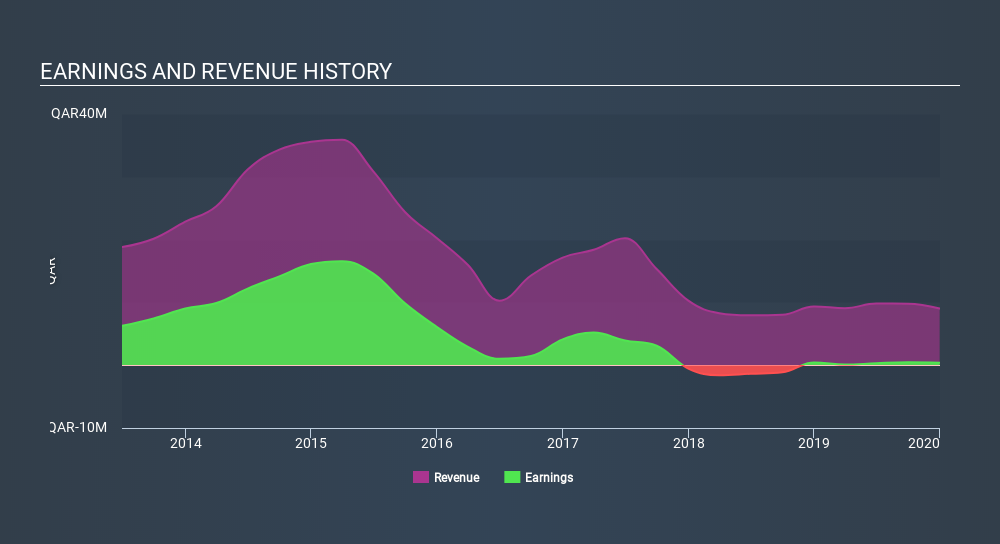

Given that Islamic Holding Group (Q.P.S.C) only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last five years Islamic Holding Group (Q.P.S.C) saw its revenue shrink by 30% per year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 35% per year in that period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Islamic Holding Group (Q.P.S.C)'s balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Islamic Holding Group (Q.P.S.C)'s total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Islamic Holding Group (Q.P.S.C)'s TSR of was a loss of 86% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Islamic Holding Group (Q.P.S.C) shareholders are down 46% for the year. Unfortunately, that's worse than the broader market decline of 12%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 32% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for Islamic Holding Group (Q.P.S.C) you should be aware of, and 2 of them are a bit unpleasant.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on QA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About DSM:IHGS

INMA Holding Company Q.P.S.C

Invests in shares and bonds; and provides brokerage services in Qatar.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives