- United Kingdom

- /

- Pharma

- /

- AIM:HCM

If You Had Bought Hutchison China MediTech (LON:HCM) Shares Five Years Ago You'd Have Made 175%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of Hutchison China MediTech Limited (LON:HCM) stock is up an impressive 175% over the last five years. It's also up 28% in about a month.

View our latest analysis for Hutchison China MediTech

Hutchison China MediTech isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Hutchison China MediTech can boast revenue growth at a rate of 16% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 22% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes Hutchison China MediTech worth investigating - it may have its best days ahead.

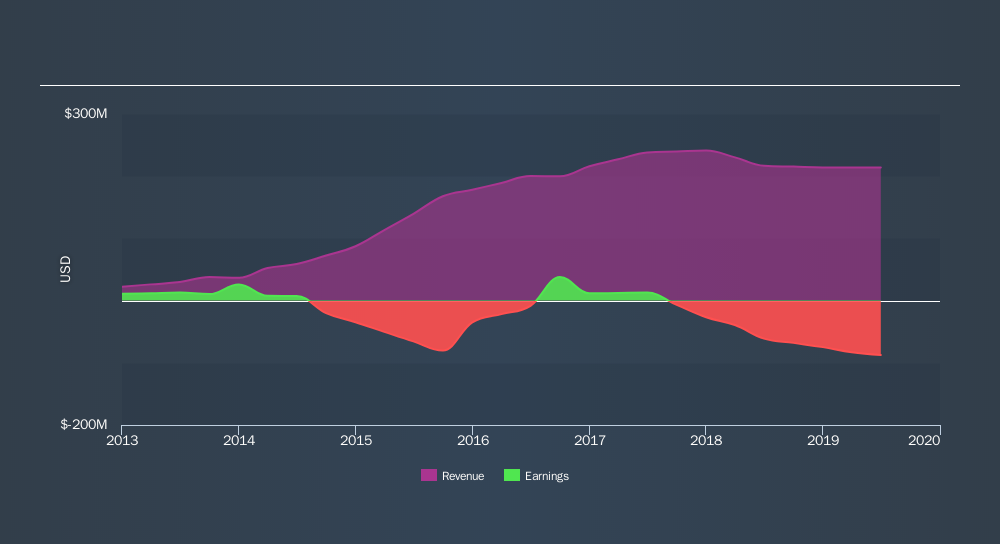

The company's revenue and earnings (over time) are depicted in the image below.

This free interactive report on Hutchison China MediTech's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Hutchison China MediTech shareholders are down 28% for the year, but the market itself is up 8.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 22% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:HCM

HUTCHMED (China)

HUTCHMED (China) Limited, together with its subsidiaries, discovers, develops, and commercializes targeted therapeutics and immunotherapies to treat cancer and immunological diseases in Hong Kong, the United States, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives