- United Kingdom

- /

- Hospitality

- /

- LSE:BOWL

If You Had Bought Hollywood Bowl Group (LON:BOWL) Shares Three Years Ago You'd Have Made 40%

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, Hollywood Bowl Group plc (LON:BOWL) shareholders have seen the share price rise 40% over three years, well in excess of the market return (3.8%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 11% , including dividends .

Check out our latest analysis for Hollywood Bowl Group

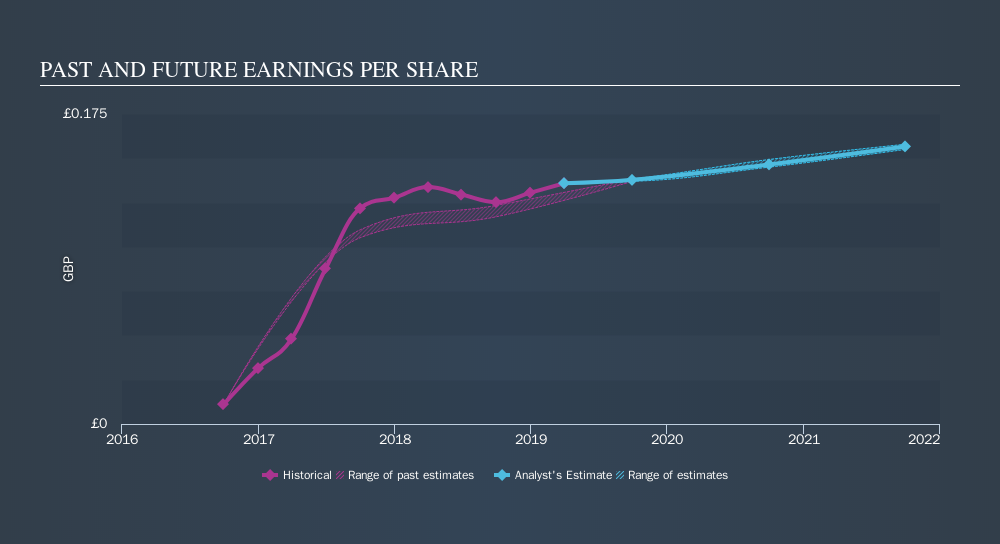

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Hollywood Bowl Group achieved compound earnings per share growth of 56% per year. This EPS growth is higher than the 12% average annual increase in the share price. So it seems investors have become more cautious about the company, over time.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Hollywood Bowl Group has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Hollywood Bowl Group stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Hollywood Bowl Group's TSR for the last 3 years was 55%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Hollywood Bowl Group rewarded shareholders with a total shareholder return of 11% over the last year. That includes the value of the dividend. The TSR has been even better over three years, coming in at 16% per year. Before spending more time on Hollywood Bowl Group it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:BOWL

Hollywood Bowl Group

Operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives