- United States

- /

- Specialized REITs

- /

- NYSE:FCPT

If You Had Bought Four Corners Property Trust (NYSE:FCPT) Shares Three Years Ago You'd Have Made 43%

Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But you can make superior returns by picking better-than average stocks. For example, the Four Corners Property Trust, Inc. (NYSE:FCPT) share price is up 43% in the last three years, slightly above the market return. Zooming in, the stock is up a respectable 9.1% in the last year.

View our latest analysis for Four Corners Property Trust

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Four Corners Property Trust actually saw its earnings per share (EPS) drop 17% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

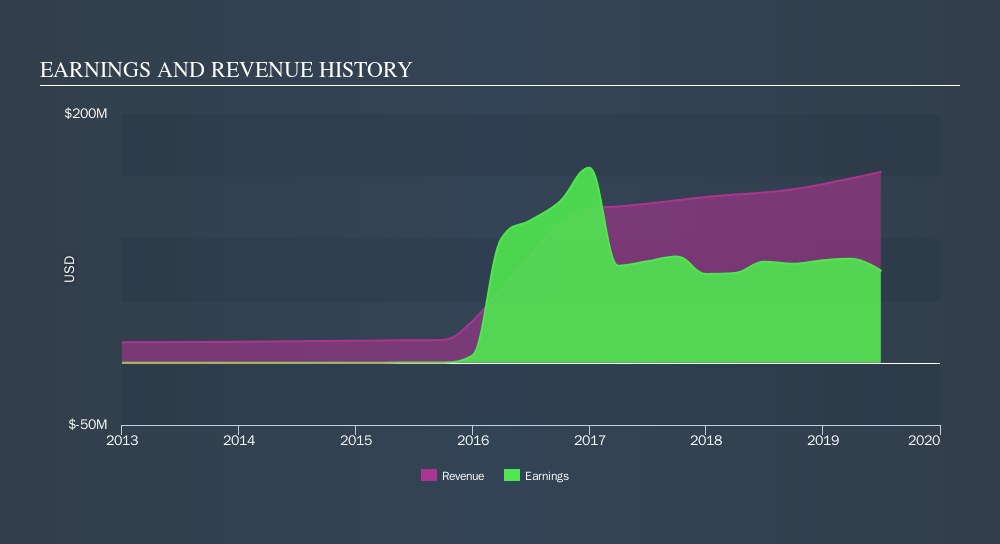

We note that the dividend is higher than it was preciously, so that may have assisted the share price. It could be that the company is reaching maturity and dividend investors are buying for the yield. On top of that, revenue grew at a rate of 12% per year, and it's likely investors interpret that as pointing to a brighter future.

You can see how revenue has changed over time in the image below.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Four Corners Property Trust, it has a TSR of 63% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the market return was 13% in the last year, Four Corners Property Trust returned 14% to shareholders. It has to be noted that the recent return falls short of the 18% shareholders have gained each year, over the last three years. Share price gains are anything but steady, so it's a positive to see that the longer term returns are reasonable. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Four Corners Property Trust may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:FCPT

Four Corners Property Trust

FCPT, headquartered in Mill Valley, CA, is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives