If You Had Bought Floridienne (EBR:FLOB) Stock Five Years Ago, You Could Pocket A 183% Gain Today

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Floridienne S.A. (EBR:FLOB) share price has soared 183% in the last half decade. Most would be very happy with that.

View our latest analysis for Floridienne

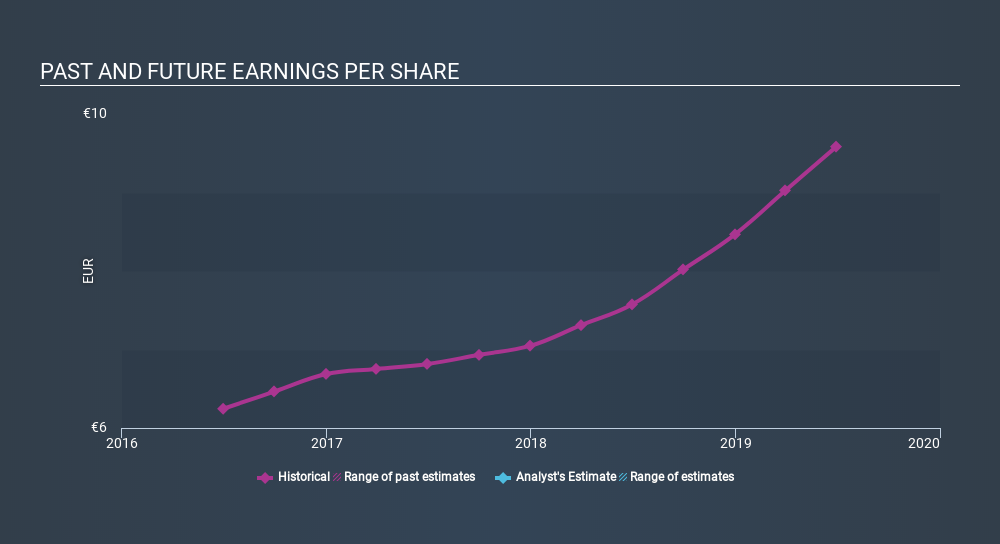

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Floridienne managed to grow its earnings per share at 104% a year. This EPS growth is higher than the 23% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Floridienne has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Floridienne the TSR over the last 5 years was 193%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Floridienne shareholders have received a total shareholder return of 24% over one year. Of course, that includes the dividend. Having said that, the five-year TSR of 24% a year, is even better. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Floridienne you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTBR:FLOB

Floridienne

Through its subsidiaries, operates in the life sciences, food, and chemistry sectors in Belgium and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives