- United States

- /

- Mortgage REITs

- /

- NYSE:ACR

If You Had Bought Exantas Capital (NYSE:XAN) Stock Five Years Ago, You'd Be Sitting On A 47% Loss, Today

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Exantas Capital Corp. (NYSE:XAN), since the last five years saw the share price fall 47%.

See our latest analysis for Exantas Capital

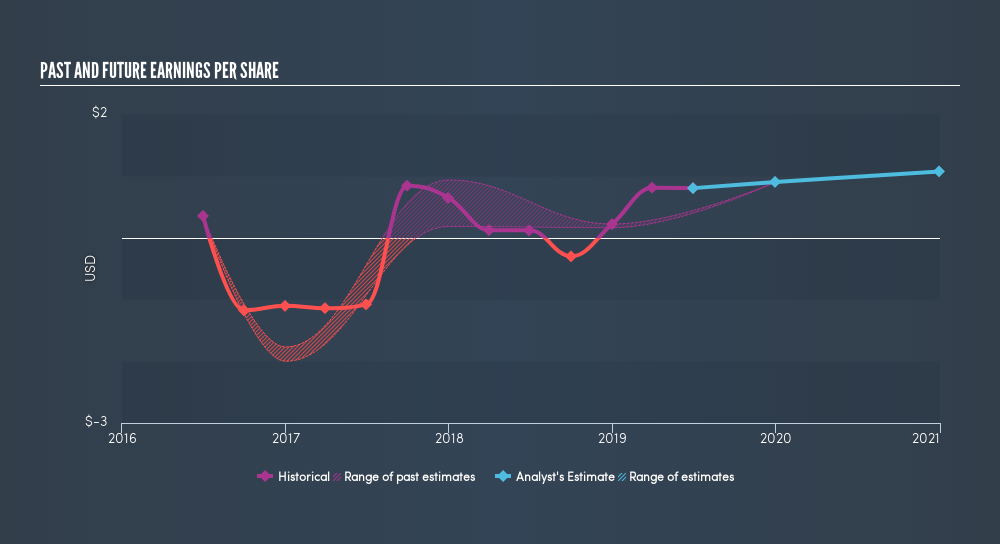

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Exantas Capital's earnings per share (EPS) dropped by 13% each year. Notably, the share price has fallen at 12% per year, fairly close to the change in the EPS. That suggests that the market sentiment around the company hasn't changed much over that time. So it's fair to say the share price has been responding to changes in EPS.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Exantas Capital's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Exantas Capital, it has a TSR of -18% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Exantas Capital shareholders gained a total return of 1.8% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 3.8% per year, over five years. So this might be a sign the business has turned its fortunes around. Importantly, we haven't analysed Exantas Capital's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course Exantas Capital may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:ACR

ACRES Commercial Realty

A real estate investment trust (REIT), focuses on the origination, holding, and management of commercial real estate mortgage loans and equity investments in commercial real estate property in the United States.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives