- Belgium

- /

- Food and Staples Retail

- /

- ENXTBR:COLR

If You Had Bought Etn. Fr. Colruyt (EBR:COLR) Stock Five Years Ago, You Could Pocket A 25% Gain Today

The last three months have been tough on Etn. Fr. Colruyt NV (EBR:COLR) shareholders, who have seen the share price decline a rather worrying 31%. But that doesn't change the fact that the returns over the last five years have been respectable. After all, the stock has performed better than the market (21%) in that time, and is up 25%.

See our latest analysis for Etn. Fr. Colruyt

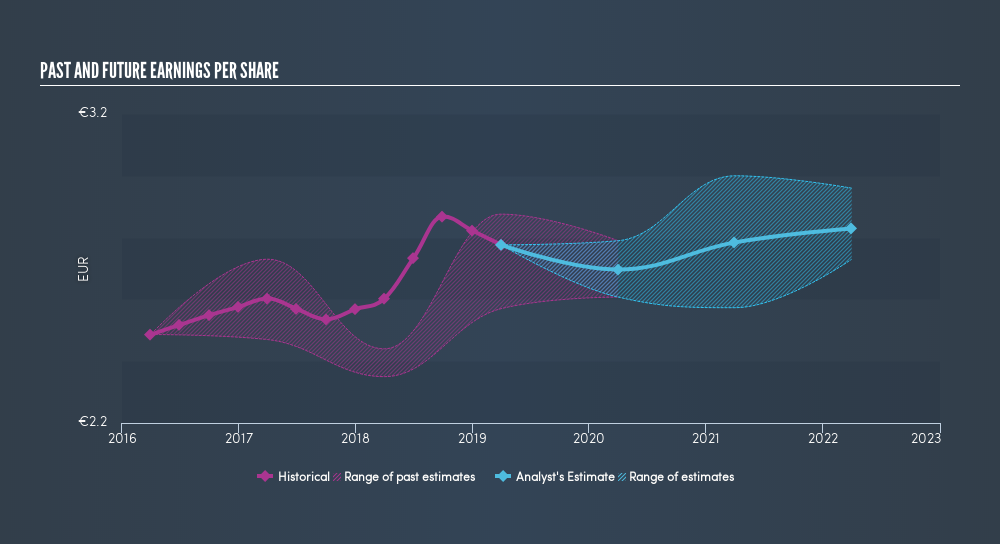

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Etn. Fr. Colruyt achieved compound earnings per share (EPS) growth of 4.4% per year. That makes the EPS growth particularly close to the yearly share price growth of 4.5%. That suggests that the market sentiment around the company hasn't changed much over that time. In fact, the share price seems to largely reflect the EPS growth.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Etn. Fr. Colruyt, it has a TSR of 37% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 2.7% in the twelve months, Etn. Fr. Colruyt shareholders did even worse, losing 11% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 6.4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Is Etn. Fr. Colruyt cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTBR:COLR

Colruyt Group

Engages in the retail, wholesale, food service, and other activities in Belgium, France, and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives