- South Africa

- /

- Trade Distributors

- /

- JSE:ENX

If You Had Bought enX Group (JSE:ENX) Stock Five Years Ago, You'd Be Sitting On A 62% Loss, Today

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. To wit, the enX Group Limited (JSE:ENX) share price managed to fall 62% over five long years. That is extremely sub-optimal, to say the least. It's up 5.0% in the last seven days.

View our latest analysis for enX Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

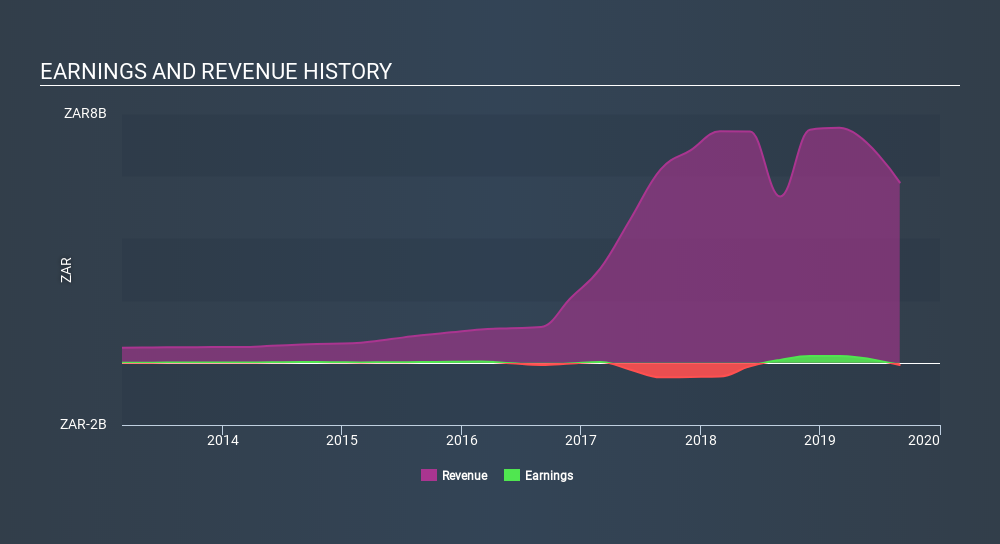

During five years of share price growth, enX Group moved from a loss to profitability. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 48% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling enX Group stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between enX Group's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for enX Group shareholders, and that cash payout explains why its total shareholder loss of 58%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 4.2% in the last year, enX Group shareholders lost 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 16% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for enX Group you should be aware of, and 1 of them shouldn't be ignored.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ZA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About JSE:ENX

enX Group

Engages in the diverse businesses in the general industrial sector in South Africa.

Excellent balance sheet low.

Market Insights

Community Narratives