If You Had Bought DIC India (NSE:DICIND) Stock Three Years Ago, You'd Be Sitting On A 40% Loss, Today

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term DIC India Limited (NSE:DICIND) shareholders, since the share price is down 40% in the last three years, falling well short of the market decline of around 5.5%. On top of that, the share price is down 6.4% in the last week.

View our latest analysis for DIC India

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

DIC India became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

With a rather small yield of just 1.5% we doubt that the stock's share price is based on its dividend. Revenue is actually up 5.0% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching DIC India more closely, as sometimes stocks fall unfairly. This could present an opportunity.

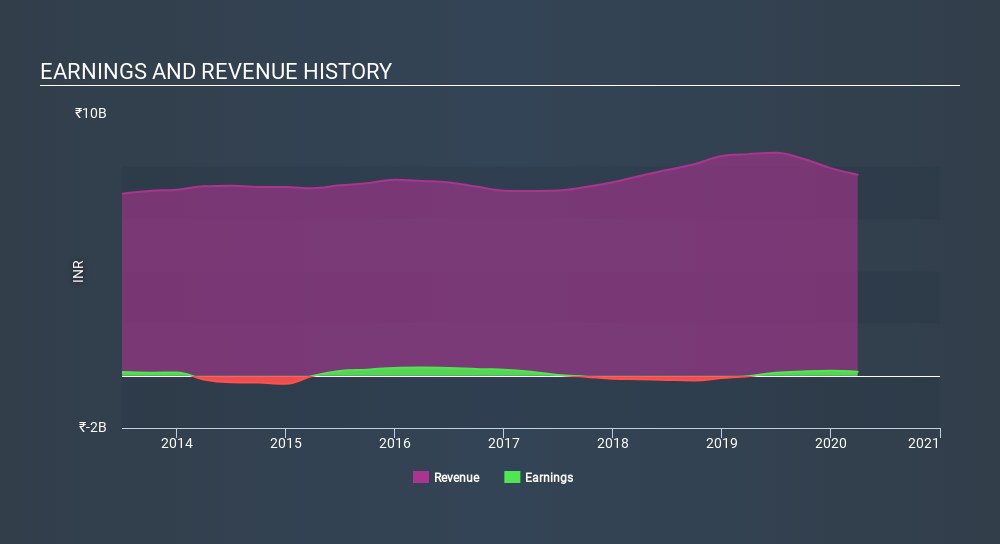

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at DIC India's financial health with this free report on its balance sheet.

A Different Perspective

While it's certainly disappointing to see that DIC India shares lost 3.7% throughout the year, that wasn't as bad as the market loss of 12%. What is more upsetting is the 7.3% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for DIC India you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:DICIND

DIC India

Manufactures and sells printing inks and allied material in India.

Flawless balance sheet with low risk.

Market Insights

Community Narratives