- United States

- /

- Software

- /

- NasdaqGS:CYBR

If You Had Bought CyberArk Software (NASDAQ:CYBR) Shares Three Years Ago You'd Have Made 112%

CyberArk Software Ltd. (NASDAQ:CYBR) shareholders might be concerned after seeing the share price drop 20% in the last month. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. Indeed, the share price is up a very strong 112% in that time. To some, the recent share price pullback wouldn't be surprising after such a good run. Only time will tell if there is still too much optimism currently reflected in the share price.

Check out our latest analysis for CyberArk Software

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

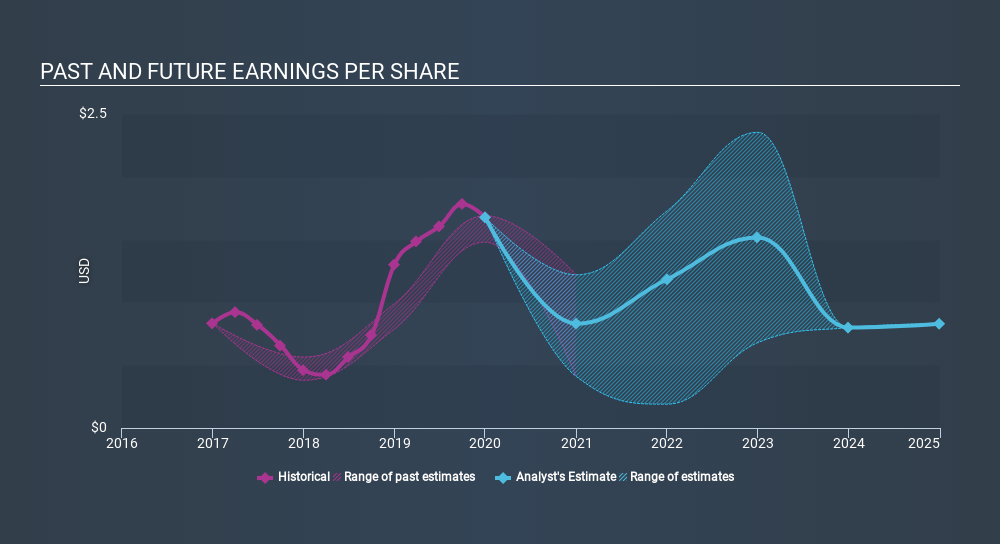

CyberArk Software was able to grow its EPS at 26% per year over three years, sending the share price higher. We note that the 29% yearly (average) share price gain isn't too far from the EPS growth rate. Coincidence? Probably not. This suggests that sentiment and expectations have not changed drastically. Quite to the contrary, the share price has arguably reflected the EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that CyberArk Software has improved its bottom line lately, but is it going to grow revenue? Check if analysts think CyberArk Software will grow revenue in the future.

A Different Perspective

CyberArk Software provided a TSR of 0.05% over the last twelve months. But that return falls short of the market. On the bright side, the longer term returns (running at about 13% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand CyberArk Software better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with CyberArk Software (including 1 which is is concerning) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives