If You Had Bought China Internet Nationwide Financial Services (NASDAQ:CIFS) Stock A Year Ago, You'd Be Sitting On A 85% Loss, Today

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. So spare a thought for the long term shareholders of China Internet Nationwide Financial Services Inc. (NASDAQ:CIFS); the share price is down a whopping 85% in the last twelve months. That'd be enough to make even the strongest stomachs churn. China Internet Nationwide Financial Services hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. On the other hand the share price has bounced 7.4% over the last week.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for China Internet Nationwide Financial Services

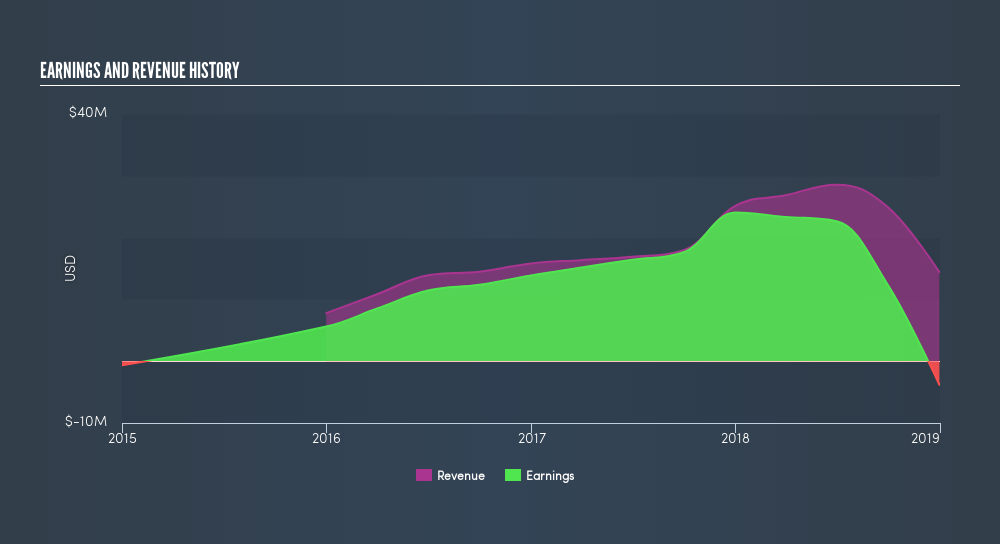

China Internet Nationwide Financial Services isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year China Internet Nationwide Financial Services saw its revenue fall by 43%. That looks pretty grim, at a glance. The share price fall of 85% in a year tells the story. That's a stern reminder that profitless companies need to grow the top line, at the very least. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

If you are thinking of buying or selling China Internet Nationwide Financial Services stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 6.0% in the last year, China Internet Nationwide Financial Services shareholders might be miffed that they lost 85%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 4.0%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of China Internet Nationwide Financial Services's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives