- Hong Kong

- /

- Hospitality

- /

- SEHK:1803

If You Had Bought Beijing Sports and Entertainment Industry Group (HKG:1803) Stock A Year Ago, You'd Be Sitting On A 92% Loss, Today

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But serious investors should think long and hard about avoiding extreme losses. So we hope that those who held Beijing Sports and Entertainment Industry Group Limited (HKG:1803) during the last year don't lose the lesson, in addition to the 92% hit to the value of their shares. A loss like this is a stark reminder that portfolio diversification is important. Even if you look out three years, the returns are still disappointing, with the share price down89% in that time. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days. Of course, this share price action may well have been influenced by the 22% decline in the broader market, throughout the period.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Beijing Sports and Entertainment Industry Group

Because Beijing Sports and Entertainment Industry Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Beijing Sports and Entertainment Industry Group's revenue didn't grow at all in the last year. In fact, it fell 26%. That looks pretty grim, at a glance. The market obviously agrees, since the share price tanked 92%. Holders should not lose the lesson: loss making companies should grow revenue. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

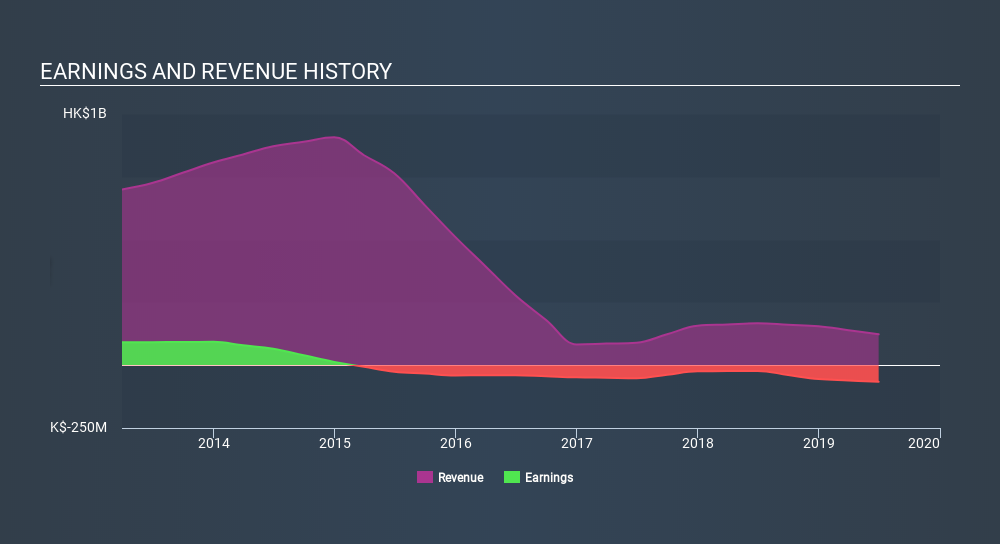

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Beijing Sports and Entertainment Industry Group's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Beijing Sports and Entertainment Industry Group shareholders are down 92% for the year. Unfortunately, that's worse than the broader market decline of 23%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 24% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Beijing Sports and Entertainment Industry Group better, we need to consider many other factors. For example, we've discovered 6 warning signs for Beijing Sports and Entertainment Industry Group (1 shouldn't be ignored!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1803

Beijing Sports and Entertainment Industry Group

An investment holding company, operates in the sports and entertainment related industry in Mainland China and Indonesia.

Excellent balance sheet low.

Market Insights

Community Narratives