- New Zealand

- /

- REITS

- /

- NZSE:APL

If You Had Bought Asset Plus (NZSE:APL) Shares A Year Ago You'd Have Made 11%

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the Asset Plus Limited (NZSE:APL) share price is up 11% in the last year, that falls short of the market return. Unfortunately the longer term returns are not so good, with the stock falling 0.8% in the last three years.

View our latest analysis for Asset Plus

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, Asset Plus actually saw its earnings per share drop 33%.

Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Absent any improvement, we don't think a thirst for dividends is pushing up the Asset Plus's share price. Revenue actually dropped 15% over last year. It's fair to say we're a little surprised to see the share price up, and that makes us cautious.

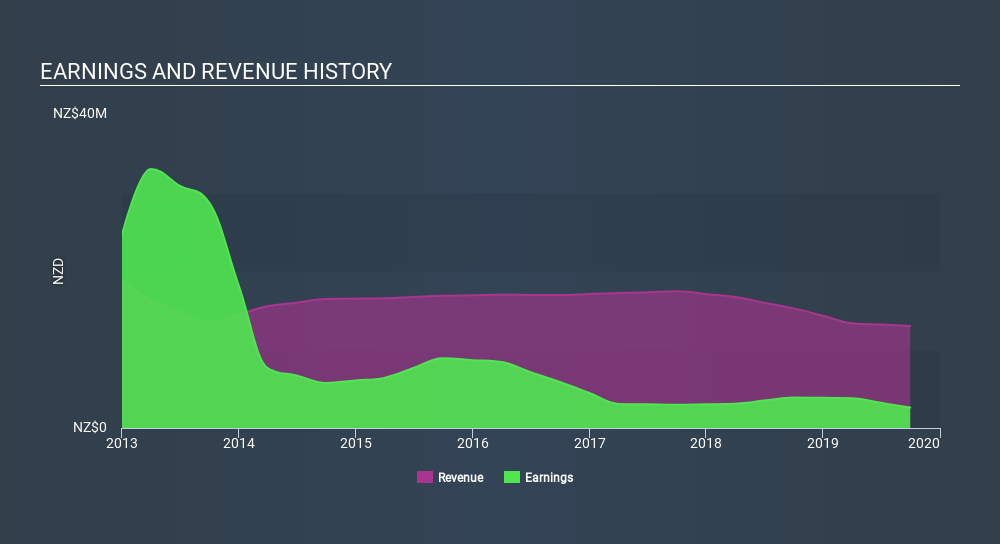

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Asset Plus's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Asset Plus's TSR for the last year was 18%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Asset Plus provided a TSR of 18% over the last twelve months. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 6.2% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. Before forming an opinion on Asset Plus you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NZSE:APL

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives