- United States

- /

- Capital Markets

- /

- NasdaqCM:AGMH

If You Had Bought AGM Group Holdings (NASDAQ:AGMH) Stock A Year Ago, You'd Be Sitting On A 36% Loss, Today

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in AGM Group Holdings Inc. (NASDAQ:AGMH) have tasted that bitter downside in the last year, as the share price dropped 36%. That's well bellow the market return of 2.9%. Because AGM Group Holdings hasn't been listed for many years, the market is still learning about how the business performs. It's down 3.0% in the last seven days.

View our latest analysis for AGM Group Holdings

AGM Group Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year AGM Group Holdings saw its revenue fall by 59%. If you think that's a particularly bad result, you're statistically on the money No surprise, then, that the share price fell 36% over the year. It's always work digging deeper, but we'd probably need to see a strong balance sheet and bottom line improvements to get interested in this one.

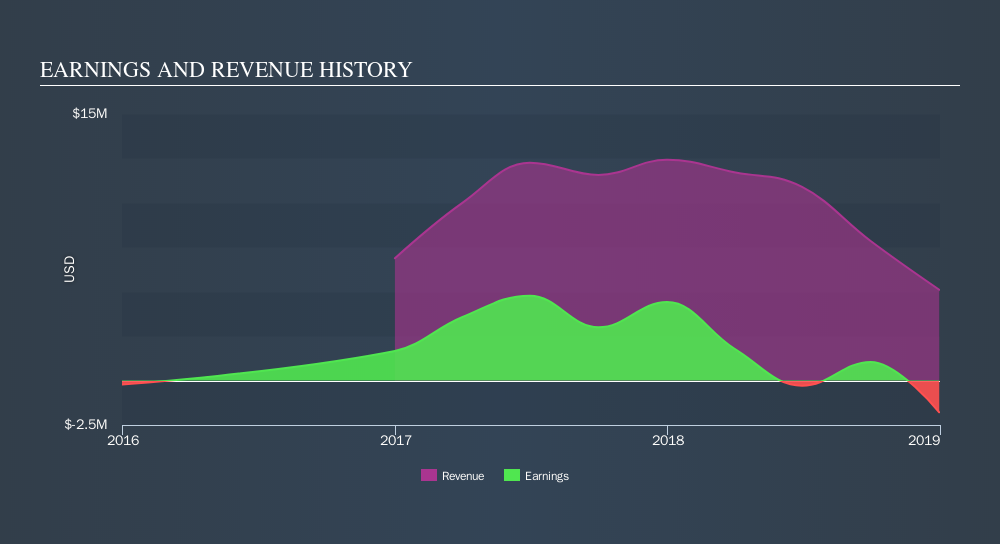

The image below shows how earnings and revenue have tracked over time.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of AGM Group Holdings's earnings, revenue and cash flow.

A Different Perspective

While AGM Group Holdings shareholders are down 36% for the year, the market itself is up 2.9%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 5.9%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course AGM Group Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:AGMH

AGM Group Holdings

A technology company, engages in the research, development, and sale of cryptocurrency mining machines and standardized computing equipment in Hong Kong, Singapore, and Mainland China.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives