- India

- /

- Auto Components

- /

- NSEI:URAVIDEF

I Ran A Stock Scan For Earnings Growth And Uravi T and Wedge Lamps (NSE:URAVI) Passed With Ease

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Uravi T and Wedge Lamps (NSE:URAVI). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Uravi T and Wedge Lamps

How Quickly Is Uravi T and Wedge Lamps Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Uravi T and Wedge Lamps's stratospheric annual EPS growth of 49%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

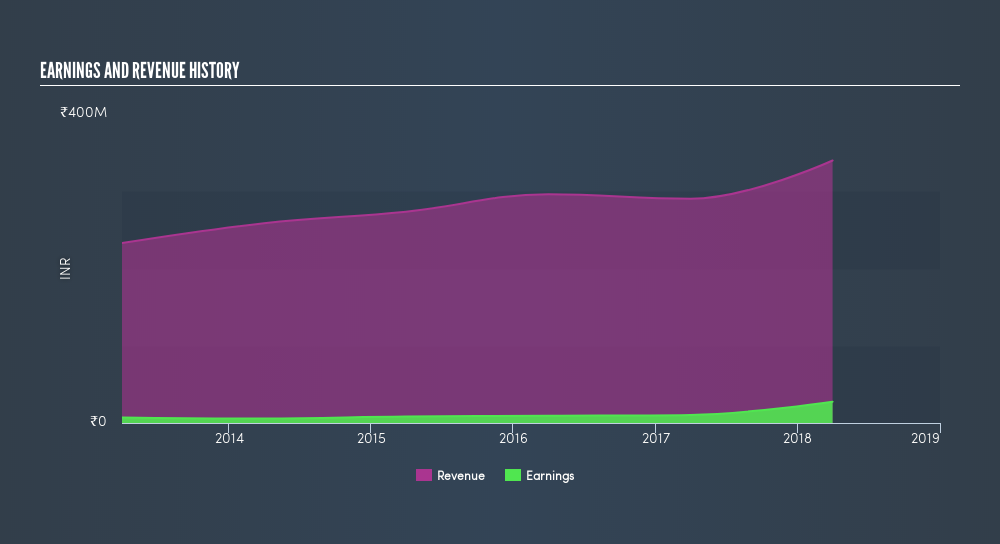

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Uravi T and Wedge Lamps shareholders can take confidence from the fact that EBIT margins are up from 11% to 15%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Uravi T and Wedge Lamps isn't a huge company, given its market capitalization of ₹633m. That makes it extra important to check on its balance sheet strength.

Are Uravi T and Wedge Lamps Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Uravi T and Wedge Lamps insiders own a significant number of shares certainly appeals to me. In fact, hey own 81% of the company, so they will share in the same delights and challenged experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, Uravi T and Wedge Lamps is a very small company, with a market cap of only ₹633m. So despite a large proportional holding, insiders only have ₹510m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Uravi T and Wedge Lamps Worth Keeping An Eye On?

Uravi T and Wedge Lamps's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Uravi T and Wedge Lamps for a spot on your watchlist. Now, you could try to make up your mind on Uravi T and Wedge Lamps by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:URAVIDEF

Uravi Defence and Technology

Manufactures and sells wedge and various types of lamps for automobiles in India.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives