- United States

- /

- Banks

- /

- NasdaqGS:SHBI

I Ran A Stock Scan For Earnings Growth And Shore Bancshares (NASDAQ:SHBI) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Shore Bancshares (NASDAQ:SHBI), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Shore Bancshares

Shore Bancshares's Earnings Per Share Are Growing.

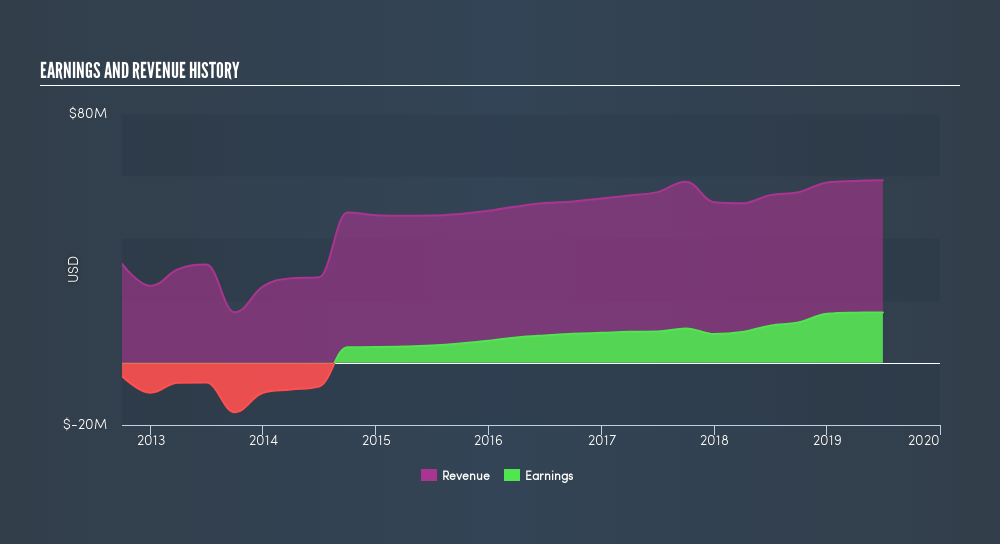

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. It certainly is nice to see that Shore Bancshares has managed to grow EPS by 22% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Shore Bancshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Shore Bancshares's EBIT margins were flat over the last year, revenue grew by a solid 8.8% to US$59m. That's progress.

Shore Bancshares isn't a huge company, given its market capitalization of US$208m. That makes it extra important to check on its balance sheet strength.

Are Shore Bancshares Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. I discovered that the median total compensation for the CEOs of companies like Shore Bancshares with market caps between US$100m and US$400m is about US$1.2m.

Shore Bancshares offered total compensation worth US$615k to its CEO in the year to December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Shore Bancshares Deserve A Spot On Your Watchlist?

For growth investors like me, Shore Bancshares's raw rate of earnings growth is a beacon in the night. With swiftly growing earnings, it probably has its best days ahead, and the modest CEO pay suggests the company is careful with cash. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. Now, you could try to make up your mind on Shore Bancshares by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:SHBI

Shore Bancshares

Operates as a bank holding company for the Shore United Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives