- United States

- /

- Specialty Stores

- /

- NYSEAM:ELA

I Ran A Stock Scan For Earnings Growth And Envela (NYSEMKT:ELA) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Envela (NYSEMKT:ELA). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Envela

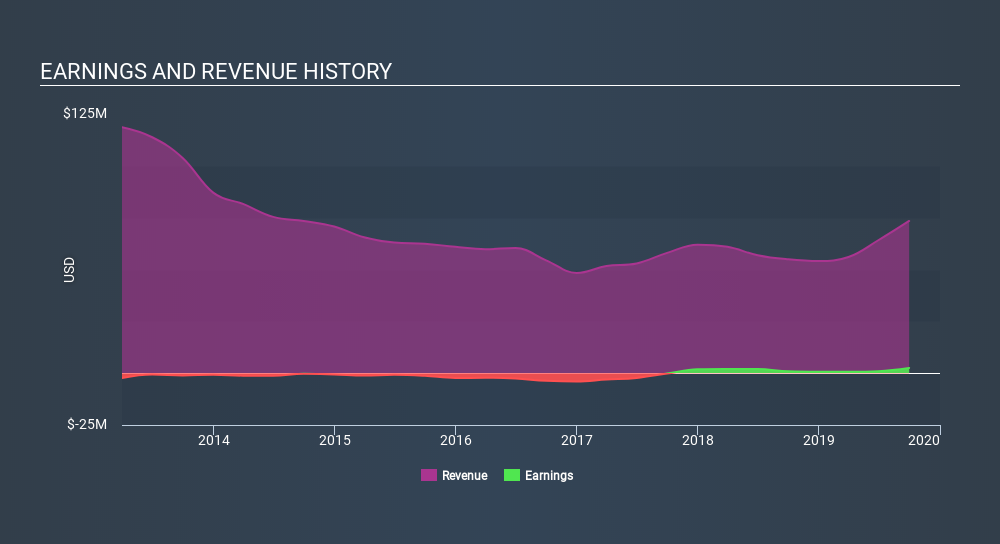

Envela's Improving Profits

In the last three years Envela's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Envela's EPS shot from US$0.033 to US$0.093, over the last year. You don't see 187% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Envela's EBIT margins were flat over the last year, revenue grew by a solid 34% to US$73m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Envela is no giant, with a market capitalization of US$40m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Envela Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Envela insiders refrain from selling stock during the year, but they also spent US$55k buying it. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was Director Allison DeStefano who made the biggest single purchase, worth US$32k, paying US$1.46 per share.

Does Envela Deserve A Spot On Your Watchlist?

Envela's earnings have taken off like any random crypto-currency did, back in 2017. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Envela on your watchlist. Now, you could try to make up your mind on Envela by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

As a growth investor I do like to see insider buying. But Envela isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSEAM:ELA

Flawless balance sheet with proven track record.

Market Insights

Community Narratives