- United States

- /

- Pharma

- /

- NasdaqCM:CORT

I Ran A Stock Scan For Earnings Growth And Corcept Therapeutics (NASDAQ:CORT) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Corcept Therapeutics (NASDAQ:CORT). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Corcept Therapeutics

How Fast Is Corcept Therapeutics Growing Its Earnings Per Share?

Over the last three years, Corcept Therapeutics has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Corcept Therapeutics's EPS soared from US$0.65 to US$0.82, over the last year. That's a commendable gain of 26%.

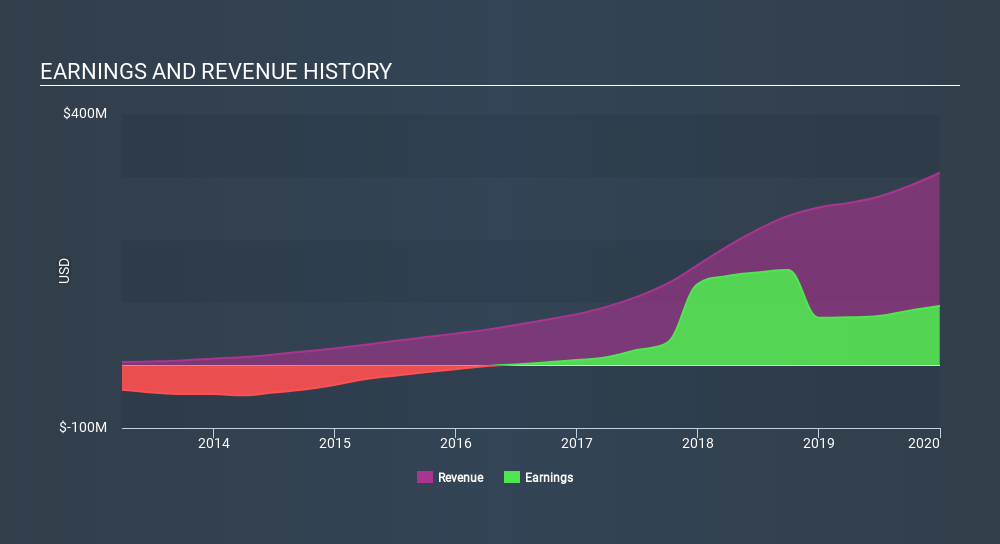

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Corcept Therapeutics maintained stable EBIT margins over the last year, all while growing revenue 22% to US$306m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Corcept Therapeutics's forecast profits?

Are Corcept Therapeutics Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Corcept Therapeutics insiders have a significant amount of capital invested in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$122m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Should You Add Corcept Therapeutics To Your Watchlist?

For growth investors like me, Corcept Therapeutics's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. Before you take the next step you should know about the 1 warning sign for Corcept Therapeutics that we have uncovered.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives