- Hong Kong

- /

- Real Estate

- /

- SEHK:1813

I Built A List Of Growing Companies And KWG Group Holdings (HKG:1813) Made The Cut

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like KWG Group Holdings (HKG:1813), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for KWG Group Holdings

How Fast Is KWG Group Holdings Growing Its Earnings Per Share?

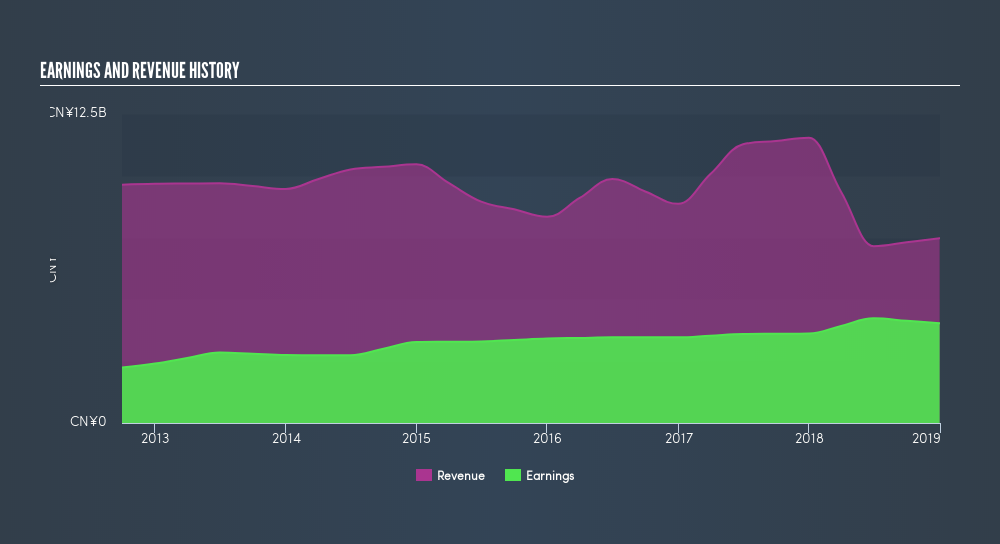

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Over twelve months, KWG Group Holdings increased its EPS from CN¥1.17 to CN¥1.28. That amounts to a small improvement of 9.2%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, revenue is down and so are margins. That is, not a hint of euphemism here, suboptimal.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of KWG Group Holdings's forecast profits?

Are KWG Group Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for KWG Group Holdings is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Chairman of the Board Jian Min Kong paid HK$34m, for stock at HK$8.41 per share. It doesn't get much better than that, in terms of large investments from insiders.

Along with the insider buying, another encouraging sign for KWG Group Holdings is that insiders, as a group, have a considerable shareholding. Indeed, they have a glittering mountain of wealth invested in it, currently valued at CN¥1.9b. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Does KWG Group Holdings Deserve A Spot On Your Watchlist?

As I already mentioned, KWG Group Holdings is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Of course, profit growth is one thing but it's even better if KWG Group Holdings is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

The good news is that KWG Group Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1813

KWG Group Holdings

Engages in the property development and investment, and hotel operation businesses in Mainland China and Hong Kong.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives