- United Kingdom

- /

- Banks

- /

- LSE:STAN

How Should Investors React To Standard Chartered's (LON:STAN) CEO Pay?

Bill Winters has been the CEO of Standard Chartered PLC (LON:STAN) since 2015, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Standard Chartered.

Check out our latest analysis for Standard Chartered

Comparing Standard Chartered PLC's CEO Compensation With the industry

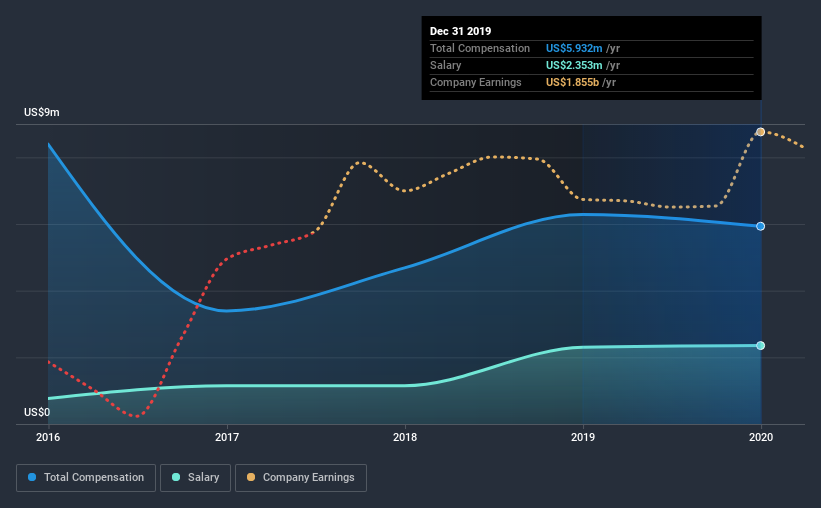

At the time of writing, our data shows that Standard Chartered PLC has a market capitalization of UK£14b, and reported total annual CEO compensation of UK£5.9m for the year to December 2019. That's a slightly lower by 5.6% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£2.4m.

For comparison, other companies in the industry with market capitalizations above UK£6.3b, reported a median total CEO compensation of UK£1.7m. Hence, we can conclude that Bill Winters is remunerated higher than the industry median. What's more, Bill Winters holds UK£8.0m worth of shares in the company in their own name.

Talking in terms of the industry, salary represented approximately 44% of total compensation out of all the companies we analyzed, while other remuneration made up 56% of the pie. There isn't a significant difference between Standard Chartered and the broader market, in terms of salary allocation in the overall compensation package. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Standard Chartered PLC's Growth

Standard Chartered PLC has seen its earnings per share (EPS) increase by 50% a year over the past three years. In the last year, its revenue changed by just 0.6%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Standard Chartered PLC Been A Good Investment?

With a three year total loss of 43% for the shareholders, Standard Chartered PLC would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we touched on above, Standard Chartered PLC is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, the earnings per share growth is certainly impressive, but we cannot say the same about the uninspiring shareholder returns (over the last three years). Considering overall performance, we can't say Bill is underpaid, in fact compensation is definitely on the higher side.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Standard Chartered (free visualization of insider trades).

Switching gears from Standard Chartered, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Standard Chartered, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:STAN

Standard Chartered

Provides various banking products and services in Asia, Africa, the Middle East, Europe, and the Americas.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Spotify - A Fundamental and Historical Valuation

Very Bullish

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.