How Should Investors React To R S Software (India)'s (NSE:RSSOFTWARE) CEO Pay?

The CEO of R S Software (India) Limited (NSE:RSSOFTWARE) is Raj Jain, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether R S Software (India) pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for R S Software (India)

Comparing R S Software (India) Limited's CEO Compensation With the industry

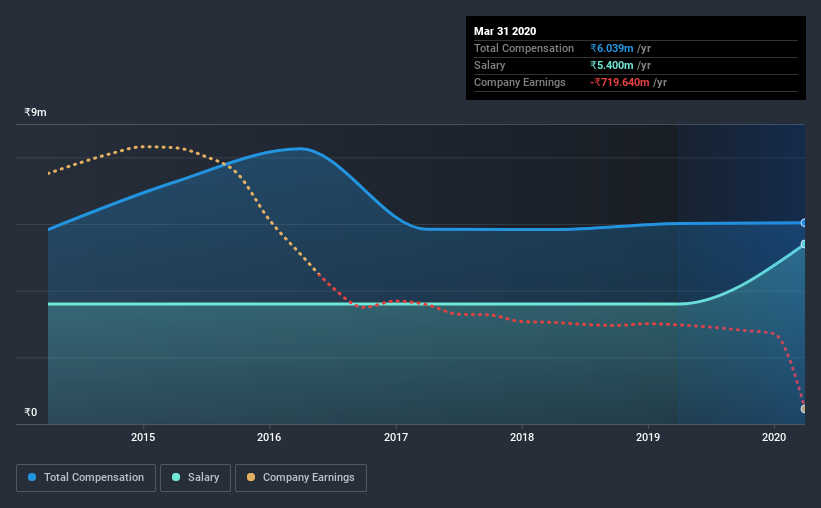

At the time of writing, our data shows that R S Software (India) Limited has a market capitalization of ₹424m, and reported total annual CEO compensation of ₹6.0m for the year to March 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of ₹5.40m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below ₹15b, we found that the median total CEO compensation was ₹4.8m. This suggests that R S Software (India) remunerates its CEO largely in line with the industry average. Moreover, Raj Jain also holds ₹169m worth of R S Software (India) stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Speaking on an industry level, nearly 100% of total compensation represents salary, while the remainder of 0.1% is other remuneration. R S Software (India) pays a modest slice of remuneration through salary, as compared to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at R S Software (India) Limited's Growth Numbers

Over the last three years, R S Software (India) Limited has shrunk its earnings per share by 32% per year. In the last year, its revenue is down 7.9%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has R S Software (India) Limited Been A Good Investment?

With a three year total loss of 78% for the shareholders, R S Software (India) Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, R S Software (India) Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Meanwhile, earnings growth and shareholder returns have been in the red for the last three years. It's tough to call out the compensation as inappropriate, but shareholders might not favor a raise before company performance improves.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for R S Software (India) you should be aware of, and 2 of them are potentially serious.

Important note: R S Software (India) is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade R S Software (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:RSSOFTWARE

R S Software (India)

Provides software solutions to electronic payment industries in India, the United States, and the United Kingdom.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Great dividend but share numbers have increased 100% in last 12 months!!

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.