- United Kingdom

- /

- REITS

- /

- LSE:SHC

How Should Investors React To Capital & Counties Properties' (LON:CAPC) CEO Pay?

Ian Hawksworth became the CEO of Capital & Counties Properties PLC (LON:CAPC) in 2010, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Capital & Counties Properties.

Check out our latest analysis for Capital & Counties Properties

Comparing Capital & Counties Properties PLC's CEO Compensation With the industry

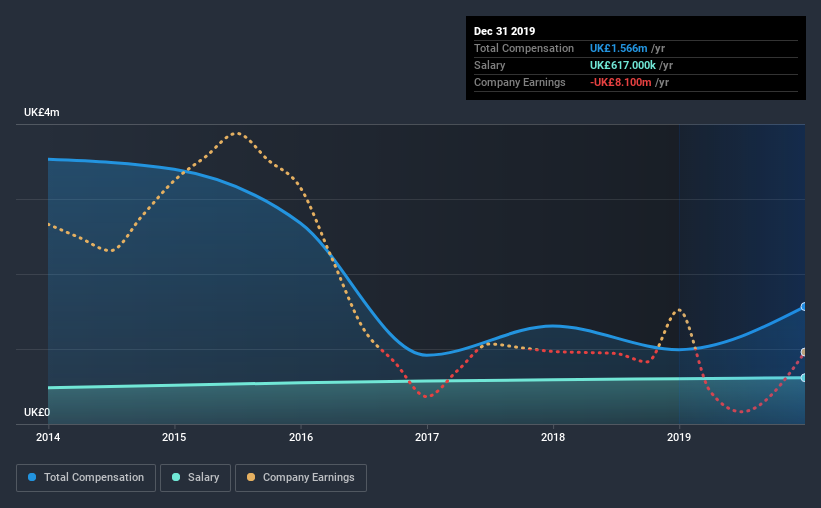

Our data indicates that Capital & Counties Properties PLC has a market capitalization of UK£1.3b, and total annual CEO compensation was reported as UK£1.6m for the year to December 2019. We note that's an increase of 58% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at UK£617k.

In comparison with other companies in the industry with market capitalizations ranging from UK£802m to UK£2.6b, the reported median CEO total compensation was UK£1.4m. This suggests that Capital & Counties Properties remunerates its CEO largely in line with the industry average. Moreover, Ian Hawksworth also holds UK£1.2m worth of Capital & Counties Properties stock directly under their own name.

On an industry level, roughly 42% of total compensation represents salary and 58% is other remuneration. Capital & Counties Properties is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Capital & Counties Properties PLC's Growth Numbers

Over the last three years, Capital & Counties Properties PLC has shrunk its earnings per share by 2.0% per year. It achieved revenue growth of 6.3% over the last year.

A lack of earnings per share improvement is not good to see. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Capital & Counties Properties PLC Been A Good Investment?

Given the total shareholder loss of 47% over three years, many shareholders in Capital & Counties Properties PLC are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As previously discussed, Ian is compensated close to the median for companies of its size, and which belong to the same industry. On the other hand, earnings growth and total shareholder return have been negative for the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Capital & Counties Properties that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Capital & Counties Properties or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:SHC

Shaftesbury Capital

Shaftesbury Capital PLC is the leading central London mixed-use REIT and is a constituent of the FTSE-250 Index.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

IA Analysis

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks