- United States

- /

- Transportation

- /

- NasdaqGM:PAMT

How Much is P.A.M. Transportation Services, Inc.'s (NASDAQ:PTSI) CEO Getting Paid?

In 2009, Daniel Cushman was appointed CEO of P.A.M. Transportation Services, Inc. (NASDAQ:PTSI). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for P.A.M. Transportation Services

How Does Daniel Cushman's Compensation Compare With Similar Sized Companies?

Our data indicates that P.A.M. Transportation Services, Inc. is worth US$212m, and total annual CEO compensation was reported as US$1.2m for the year to December 2019. That's actually a decrease on the year before. While we always look at total compensation first, we note that the salary component is less, at US$628k. We examined companies with market caps from US$100m to US$400m, and discovered that the median CEO total compensation of that group was US$1.4m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where P.A.M. Transportation Services stands. Talking in terms of the sector, salary represented approximately 19% of total compensation out of all the companies we analysed, while other remuneration made up 81% of the pie. It's interesting to note that P.A.M. Transportation Services pays out a greater portion of remuneration through salary, in comparison to the wider industry.

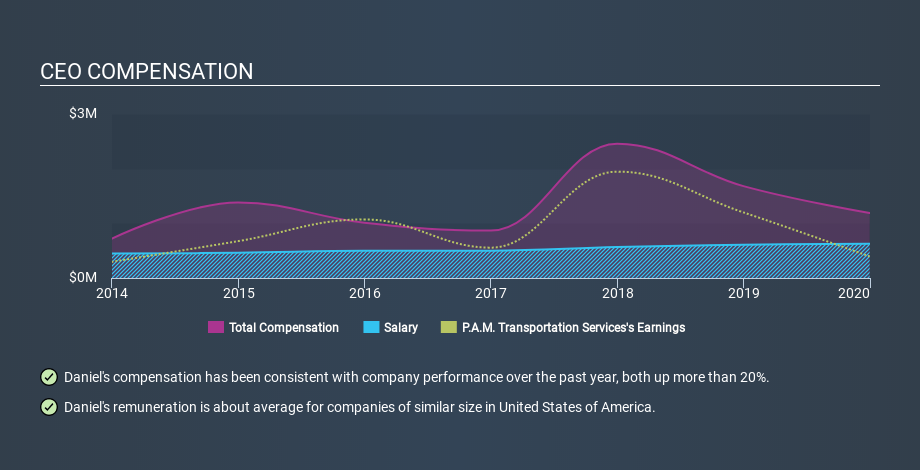

So Daniel Cushman is paid around the average of the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance. The graphic below shows how CEO compensation at P.A.M. Transportation Services has changed from year to year.

Is P.A.M. Transportation Services, Inc. Growing?

Over the last three years P.A.M. Transportation Services, Inc. has shrunk its earnings per share by an average of 2.4% per year (measured with a line of best fit). Its revenue is down 5.1% over last year.

In the last three years the company has failed to grow earnings per share. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Shareholders might be interested in this free visualization of analyst forecasts.

Has P.A.M. Transportation Services, Inc. Been A Good Investment?

I think that the total shareholder return of 121%, over three years, would leave most P.A.M. Transportation Services, Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Remuneration for Daniel Cushman is close enough to the median pay for a CEO of a similar sized company .

We feel that earnings per share have been a bit disappointing, but it's nice to see positive shareholder returns over the last three years. So we doubt many are complaining about the fairly normal CEO pay. Shifting gears from CEO pay for a second, we've picked out 1 warning sign for P.A.M. Transportation Services that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:PAMT

Pamt

Through its subsidiaries, operates as a truckload transportation and logistics company in the United States, Mexico, and Canada.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion