- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NATI

How Much is National Instruments Corporation's (NASDAQ:NATI) CEO Getting Paid?

Alex Davern has been the CEO of National Instruments Corporation (NASDAQ:NATI) since 2017. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for National Instruments

How Does Alex Davern's Compensation Compare With Similar Sized Companies?

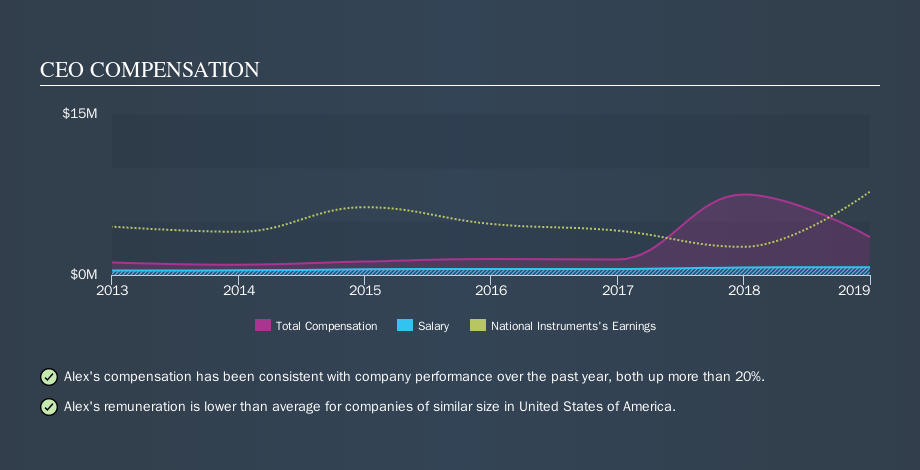

At the time of writing, our data says that National Instruments Corporation has a market cap of US$5.3b, and reported total annual CEO compensation of US$3.5m for the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at US$725k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$4.0b to US$12b. The median total CEO compensation was US$6.8m.

A first glance this seems like a real positive for shareholders, since Alex Davern is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see a visual representation of the CEO compensation at National Instruments, below.

Is National Instruments Corporation Growing?

Over the last three years National Instruments Corporation has grown its earnings per share (EPS) by an average of 18% per year (using a line of best fit). It achieved revenue growth of 2.1% over the last year.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. Shareholders might be interested in this free visualization of analyst forecasts.

Has National Instruments Corporation Been A Good Investment?

Boasting a total shareholder return of 54% over three years, National Instruments Corporation has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

National Instruments Corporation is currently paying its CEO below what is normal for companies of its size.

Many would consider this to indicate that the pay is modest since the business is growing. The pleasing shareholder returns are the cherry on top; you might even consider that Alex Davern deserves a raise! It is relatively rare to see a modestly paid CEO when performance is so impressive. The cherry on top would be if company insiders are buying shares with their own money. So you may want to check if insiders are buying National Instruments shares with their own money (free access).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:NATI

National Instruments

National Instruments Corporation provides a software-centric platform to engineers and scientists worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)