- Belgium

- /

- Food and Staples Retail

- /

- ENXTBR:COLR

How Much is Etn. Fr. Colruyt NV's (EBR:COLR) CEO Getting Paid?

Jef Colruyt is the CEO of Etn. Fr. Colruyt NV (EBR:COLR). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for Etn. Fr. Colruyt

How Does Jef Colruyt's Compensation Compare With Similar Sized Companies?

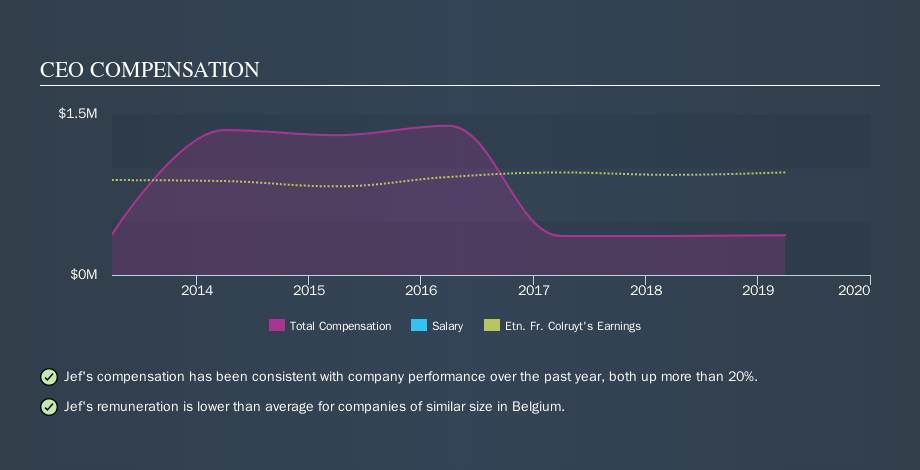

At the time of writing, our data says that Etn. Fr. Colruyt NV has a market cap of €6.6b, and reported total annual CEO compensation of €370k for the year to March 2019. That's just a smallish increase of 1.6% on last year. While we always look at total compensation first, we note that the salary component is less, at . We note that more than half of the total compensation is not the salary; and performance requirements may apply to this non-salary portion. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of €3.6b to €11b. The median total CEO compensation was €812k.

A first glance this seems like a real positive for shareholders, since Jef Colruyt is paid less than the average total compensation paid by similar sized companies. While this is a good thing, you'll need to understand the business better before you can form an opinion.

You can see a visual representation of the CEO compensation at Etn. Fr. Colruyt, below.

Is Etn. Fr. Colruyt NV Growing?

Etn. Fr. Colruyt NV has increased its earnings per share (EPS) by an average of 4.2% a year, over the last three years (using a line of best fit). It achieved revenue growth of 4.5% over the last year.

I'd prefer higher revenue growth, but I'm happy with the modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information.

Has Etn. Fr. Colruyt NV Been A Good Investment?

With a total shareholder return of 2.1% over three years, Etn. Fr. Colruyt NV has done okay by shareholders. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

It appears that Etn. Fr. Colruyt NV remunerates its CEO below most similar sized companies.

Jef Colruyt is paid less than what is normal at similar size companies, and but overall performance has left me uninspired. However I do not find the CEO compensation to be concerning. Whatever your view on compensation, you might want to check if insiders are buying or selling Etn. Fr. Colruyt shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTBR:COLR

Colruyt Group

Engages in the retail, wholesale, food service, and other activities in Belgium, France, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion