The CEO of Delta Plus Group (EPA:DLTA) is Jérôme Benoit. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Delta Plus Group

How Does Jérôme Benoit's Compensation Compare With Similar Sized Companies?

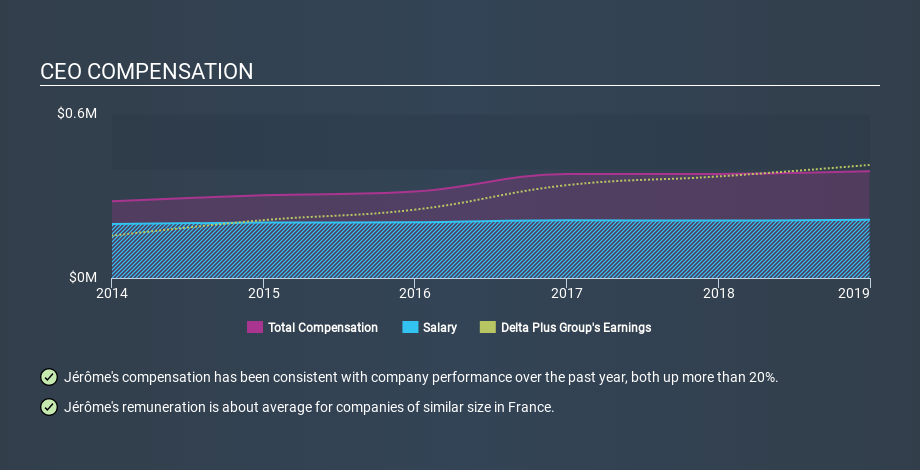

At the time of writing, our data says that Delta Plus Group has a market cap of €281m, and reported total annual CEO compensation of €390k for the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at €213k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of €178m to €711m. The median total CEO compensation was €487k.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. Speaking on an industry level, we can see that nearly 73% of total compensation represents salary, while the remainder of 27% is other remuneration. So it seems like there isn't a significant difference between Delta Plus Group and the broader market, in terms of salary allocation in the overall compensation package.

That means Jérôme Benoit receives fairly typical remuneration for the CEO of a company that size. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance. You can see a visual representation of the CEO compensation at Delta Plus Group, below.

Is Delta Plus Group Growing?

Over the last three years Delta Plus Group has seen earnings per share (EPS) move in a positive direction by an average of 15% per year (using a line of best fit). Its revenue is up 9.5% over last year.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. Shareholders might be interested in this free visualization of analyst forecasts.

Has Delta Plus Group Been A Good Investment?

Given the total loss of 8.7% over three years, many shareholders in Delta Plus Group are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Jérôme Benoit is paid around the same as most CEOs of similar size companies.

We think that the EPS growth is very pleasing, but we find the returns over the last three years to be lacking. We'd be surprised if shareholders want to see a pay rise for the CEO, but we'd stop short of calling their pay too generous. CEO compensation is an important area to keep your eyes on, but we've also identified 3 warning signs for Delta Plus Group (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Important note: Delta Plus Group may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTPA:ALDLT

Delta Plus Group

Engages in design, manufacture, and distribution of a range of personal protective equipment worldwide.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!