- United States

- /

- Consumer Finance

- /

- NasdaqGS:MFIN

How Much Did Medallion Financial's(NASDAQ:MFIN) Shareholders Earn From Share Price Movements Over The Last Five Years?

Medallion Financial Corp. (NASDAQ:MFIN) shareholders will doubtless be very grateful to see the share price up 49% in the last quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. Indeed, the share price is down 62% in the period. So we're hesitant to put much weight behind the short term increase. Of course, this could be the start of a turnaround.

View our latest analysis for Medallion Financial

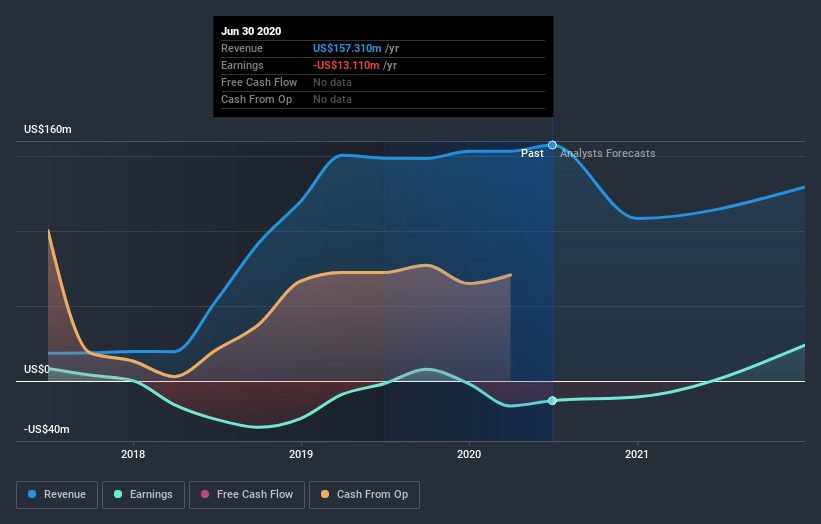

Medallion Financial wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Medallion Financial grew its revenue at 40% per year. That's well above most other pre-profit companies. In contrast, the share price is has averaged a loss of 10% per year - that's quite disappointing. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Medallion Financial's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Medallion Financial's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Medallion Financial's TSR of was a loss of 57% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Medallion Financial shareholders are down 33% for the year, but the market itself is up 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9.4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Medallion Financial better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Medallion Financial (including 1 which is can't be ignored) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Medallion Financial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:MFIN

Medallion Financial

Operates as a specialty finance company in the United States.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives