- Australia

- /

- Metals and Mining

- /

- ASX:IMA

How Does Image Resources' (ASX:IMA) CEO Pay Compare With Company Performance?

Patrick Mutz became the CEO of Image Resources NL (ASX:IMA) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Image Resources pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Image Resources

Comparing Image Resources NL's CEO Compensation With the industry

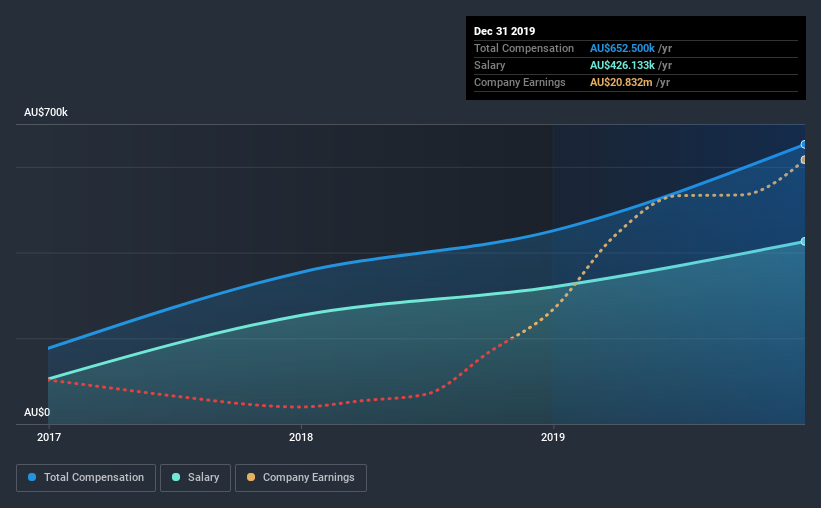

According to our data, Image Resources NL has a market capitalization of AU$167m, and paid its CEO total annual compensation worth AU$653k over the year to December 2019. Notably, that's an increase of 45% over the year before. We note that the salary portion, which stands at AU$426.1k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$286m, we found that the median total CEO compensation was AU$307k. Accordingly, our analysis reveals that Image Resources NL pays Patrick Mutz north of the industry median. What's more, Patrick Mutz holds AU$454k worth of shares in the company in their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | AU$426k | AU$320k | 65% |

| Other | AU$226k | AU$131k | 35% |

| Total Compensation | AU$653k | AU$451k | 100% |

Talking in terms of the industry, salary represented approximately 70% of total compensation out of all the companies we analyzed, while other remuneration made up 30% of the pie. There isn't a significant difference between Image Resources and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Image Resources NL's Growth

Image Resources NL has seen its earnings per share (EPS) increase by 105% a year over the past three years. Its revenue is up 759% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term earnings per share improvement certainly points to the kind of growth we like to see. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Image Resources NL Been A Good Investment?

Boasting a total shareholder return of 79% over three years, Image Resources NL has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As we touched on above, Image Resources NL is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Importantly though, earnings per share growth and shareholder returns are very impressive over the last three years. Considering such exceptional results for the company, we'd venture to say CEO compensation is fair. And given most shareholders are probably very happy with recent returns, they might even think that Patrick deserves a raise!

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Image Resources that investors should think about before committing capital to this stock.

Important note: Image Resources is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Image Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:IMA

Image Resources

Engages in the production and exploration of mineral sands in Western Australia.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health - Valuation

TAV Havalimanlari Holding will soar with €2.5 billion investments fueling future growth

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.

NVDA+AEVA Agreement is a game changer for the AEVA stock even though it is just a partnership and does not have a roll out until 2028 (which means receivables as early as 2027, I would imagine) This agreement effectively moves the goal posts of profitability for AEVA much closer since this is in addition to the recent Forterra agreement, as well as the (just announced) European carmaker agreement (which is believed to be Mercedes-Benz). Underneath all of this, AEVA has a pre-existing agreement with Daimler truck. So business seems to be booming, especially with really big name brands…which tends to bring in even more brand names (and thus more agreements/contracts/announcements, etc). This dynamic often creates more coverage from analysts (often with upside stock initial coverage) that I believe will be occurring over the next 3 to 6 months (as professional traders/analysts often research for 2 to 3 months before initiating coverage of a new issue). Anyway, this all just one opinion , so please do your own due diligence. Disclaimer: I/We DO trade in this stock from time to time and I/we may (or may not have) a position currently, so again, please do your own due diligence.