- Australia

- /

- Transportation

- /

- ASX:A2B

How Does A2B Australia's (ASX:A2B) P/E Compare To Its Industry, After Its Big Share Price Gain?

A2B Australia (ASX:A2B) shares have had a really impressive month, gaining 33%, after some slippage. But shareholders may not all be feeling jubilant, since the share price is still down 49% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

View our latest analysis for A2B Australia

How Does A2B Australia's P/E Ratio Compare To Its Peers?

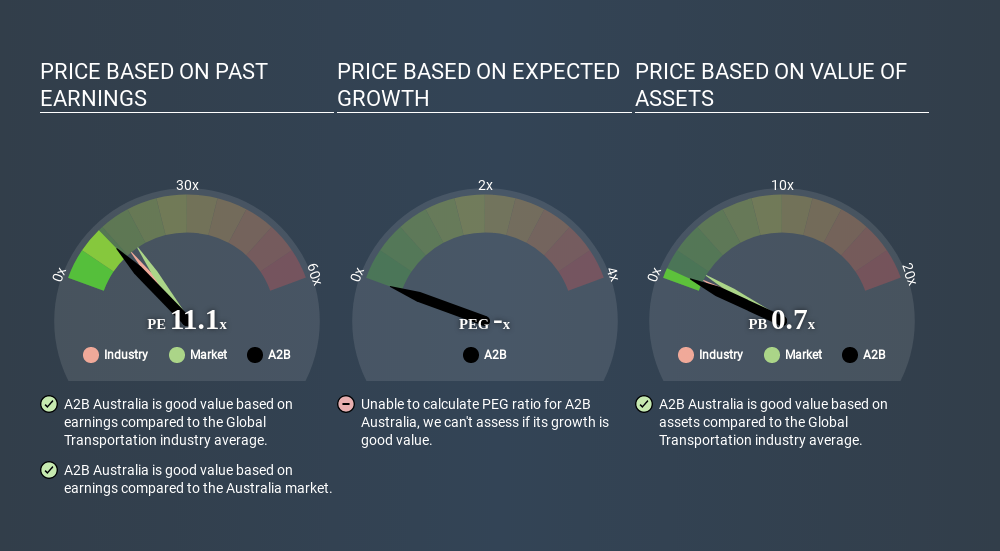

We can tell from its P/E ratio of 11.10 that sentiment around A2B Australia isn't particularly high. We can see in the image below that the average P/E (13.3) for companies in the transportation industry is higher than A2B Australia's P/E.

Its relatively low P/E ratio indicates that A2B Australia shareholders think it will struggle to do as well as other companies in its industry classification. Since the market seems unimpressed with A2B Australia, it's quite possible it could surprise on the upside. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. Earnings growth means that in the future the 'E' will be higher. And in that case, the P/E ratio itself will drop rather quickly. Then, a lower P/E should attract more buyers, pushing the share price up.

It's great to see that A2B Australia grew EPS by 15% in the last year. But earnings per share are down 28% per year over the last five years.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

A2B Australia's Balance Sheet

A2B Australia has net cash of AU$5.9m. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Bottom Line On A2B Australia's P/E Ratio

A2B Australia has a P/E of 11.1. That's below the average in the AU market, which is 15.5. Not only should the net cash position reduce risk, but the recent growth has been impressive. The below average P/E ratio suggests that market participants don't believe the strong growth will continue. What is very clear is that the market has become more optimistic about A2B Australia over the last month, with the P/E ratio rising from 8.3 back then to 11.1 today. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

Investors have an opportunity when market expectations about a stock are wrong. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: A2B Australia may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:A2B

A2B Australia

A2B Australia Limited, together with its subsidiaries, provides technologies, bookings, dispatch, payment, and taxi related services in Australia.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.