- Australia

- /

- Retail REITs

- /

- ASX:VCX

How Do Analysts See Vicinity Centres (ASX:VCX) Performing Over The Next Year?

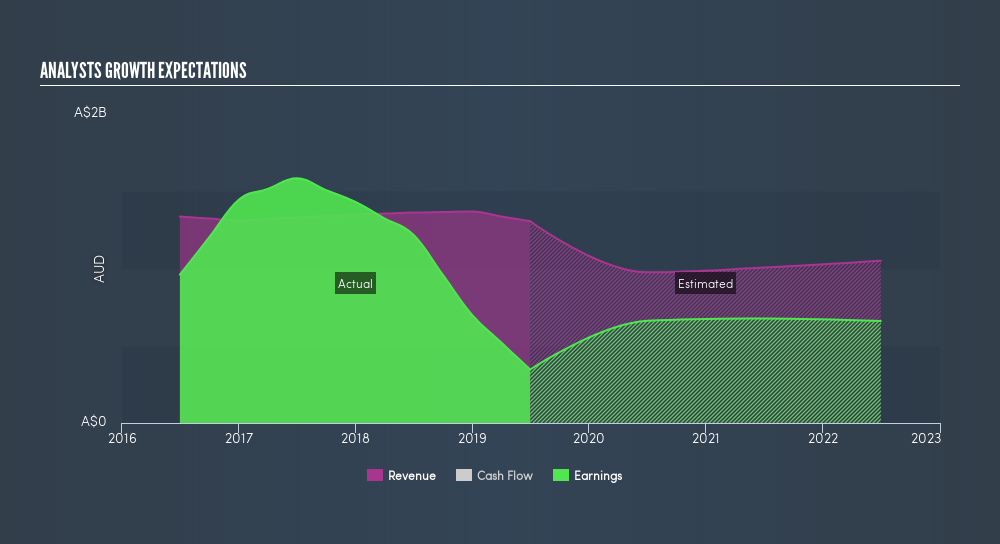

After Vicinity Centres's (ASX:VCX) earnings announcement on 30 June 2019, the consensus outlook from analysts appear highly confident, with earnings expected to grow by a high double-digit of 91% in the upcoming year, compared with the historical 5-year average growth rate of 8.5%. By 2020, we can expect Vicinity Centres’s bottom line to reach AU$660m, a jump from the current trailing-twelve-month of AU$346m. I will provide a brief commentary around the figures and analyst expectations in the near term. For those keen to understand more about other aspects of the company, you can research its fundamentals here.

Check out our latest analysis for Vicinity Centres

Can we expect Vicinity Centres to keep growing?

The longer term view from the 5 analysts covering VCX is one of positive sentiment. Broker analysts tend to forecast up to three years ahead due to a lack of clarity around the business trajectory beyond this. I've plotted out each year's earnings expectations and inserted a line of best fit to calculate an annual growth rate from the slope in order to understand the overall trajectory of VCX's earnings growth over these next few years.

From the current net income level of AU$346m and the final forecast of AU$660m by 2022, the annual rate of growth for VCX’s earnings is 21%. This leads to an EPS of A$0.18 in the final year of projections relative to the current EPS of A$0.090. With a current profit margin of 27%, this movement will result in a margin of 63% by 2022.

Next Steps:

Future outlook is only one aspect when you're building an investment case for a stock. For Vicinity Centres, I've compiled three pertinent factors you should further examine:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is Vicinity Centres worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Vicinity Centres is currently mispriced by the market.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Vicinity Centres? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:VCX

Vicinity Centres

Vicinity Centres (Vicinity or the Group) is one of Australia's leading retail property groups with a fully integrated asset management platform, and $24 billion in retail assets under management across 52 shopping centres, making it the second largest listed manager of Australian retail property.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Investment Thesis: Costco Wholesale (COST)

The "Sleeping Giant" Stumbles, Then Wakes Up

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion