- United States

- /

- Industrials

- /

- NasdaqGS:HON

Honeywell International (HON) Raises 2025 Sales Guidance, Reports Q2 Revenue Growth

Reviewed by Simply Wall St

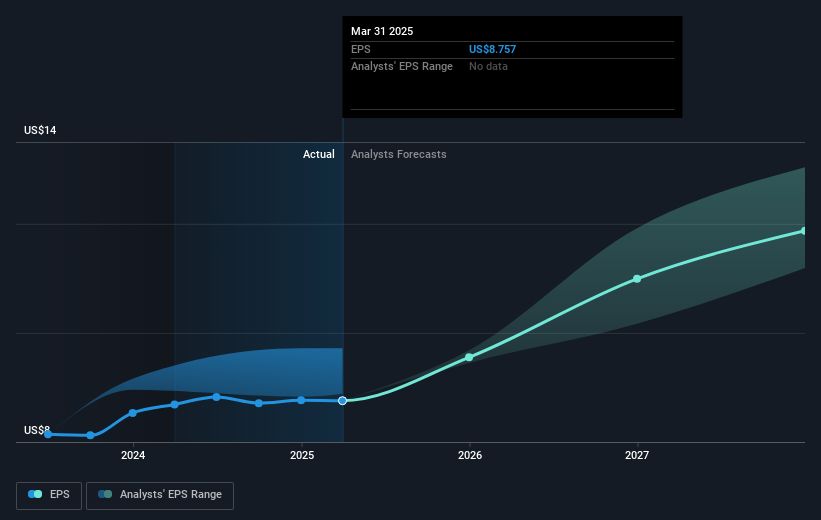

Honeywell International (HON) recently raised its earnings guidance for the full year 2025, following strong second-quarter results with revenue climbing 8% year-over-year. This financial strength coincided with a price move of 19% over the last quarter, aligning with the broader market's robust 18% growth over the past 12 months. Honeywell's positive financial news, including increased guidance and strategic steps such as evaluating alternatives for certain business units and a significant acquisition, seem to have added weight to its share price performance, supporting its upward trajectory alongside broader market trends.

The recent news of Honeywell International’s earnings guidance revision and strong quarterly results may offer insights into the company's long-term trajectory. Over the last five years, Honeywell's total shareholder return, including dividends, reached 71.26%, reflecting an enduring capacity to generate investment value. However, in the past year, Honeywell underperformed compared to the broader US Market and the Industrials industry, which provided higher returns. This mixed picture suggests that while the company has successfully delivered value in the long term, it faces challenges that could impact short-term performance relative to peers.

Honeywell's updated guidance, combined with strategic decisions like evaluating business alternatives and acquisitions, signals a focus on repositioning for future growth. These moves could influence revenue and earnings forecasts by bolstering targeted segments such as automation and aerospace. However, the share price, sitting at $239.27, is slightly below the consensus price target of $246.63, indicating that some market participants may perceive limited upside in the short term. These expectations are aligned with concerns over tariffs and global economic conditions, which might weigh on revenue prospects and margin expansion efforts despite the company's ongoing strategies.

Evaluate Honeywell International's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honeywell International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HON

Honeywell International

Engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses in the United States, Europe, and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives