- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Soars 55% Over Last Quarter

Reviewed by Simply Wall St

Hewlett Packard Enterprise (NYSE:HPE) recently affirmed a cash dividend and launched new innovative products, including expanding its server portfolio and AI Factory Solutions, which coincides with its remarkable 55% share price surge over the last quarter. The company also resolved legal issues with the U.S. Department of Justice related to its acquisition of Juniper Networks, enabling a significant transaction closure. These developments happened against a backdrop where tech stocks, including major indexes like the S&P 500 and Nasdaq, continue to reach record highs. While the broader market's positive momentum aligns with HPE's performance, these specific company events likely strengthened its upward price trajectory.

You should learn about the 4 warning signs we've spotted with Hewlett Packard Enterprise.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

The recent announcements by Hewlett Packard Enterprise (HPE) regarding its dividend affirmation and product launches, including enhancements to its server portfolio and AI Factory Solutions, signal an aggressive push towards bolstering its competitiveness in the tech sector. These moves could potentially accelerate HPE's revenue and earnings growth, particularly given its focus on AI and cloud strategies. While the recent 55% share price surge aligns well with broader market highs, such as the S&P 500 and Nasdaq, it also suggests investor confidence in the company's strategic direction and its ability to integrate Juniper Networks effectively, contingent on resolving regulatory challenges.

Over the past five years, HPE has delivered a total return of 170.51%, showcasing significant long-term growth despite short-term volatility. This long-term performance provides a stark contrast to the past year's industry figures, where HPE exceeded the US Tech industry's performance but underperformed relative to the broader market, which saw a 13.2% return.

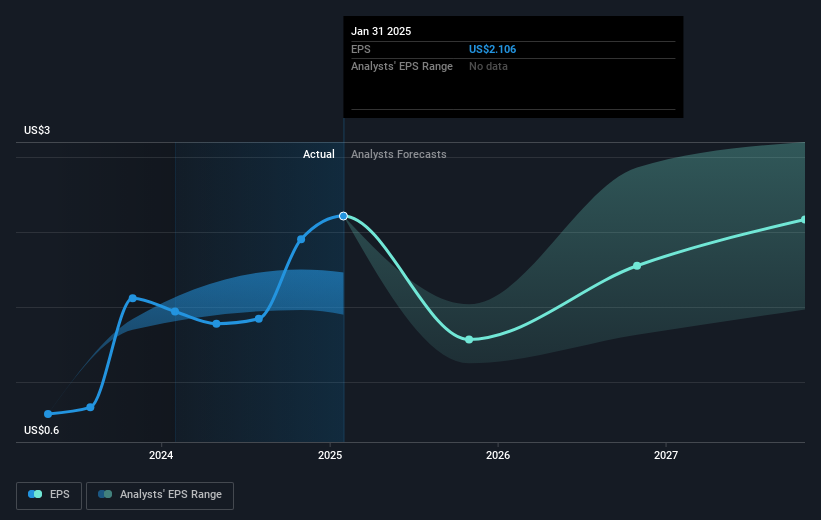

The strategic decisions and product expansions mentioned are expected to impact HPE's financial projections. Analysts forecast a revenue growth of 4.9% annually, although challenges such as tariffs and competitive pressures could influence these forecasts. In terms of earnings, despite a projected decline in profit margins from 8.9% to 7.5% over the next three years, analysts anticipate earnings to reach US$2.7 billion by 2028. The current share price of US$16.49 is at a slight discount compared to the consensus price target of US$18.98, suggesting potential upside if the company's strategic initiatives successfully translate into financial gains. However, the effectiveness of ongoing strategies and mitigation measures against external pressures remains crucial.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives