- United States

- /

- Food

- /

- NYSE:HSY

Hershey (HSY) Reports Lower Earnings But Announces Exciting REESE'S and OREO Collaboration

Reviewed by Simply Wall St

Hershey (HSY) recently unveiled its Q2 2025 earnings, showing substantial sales growth but a significant dip in net income and earnings per share. Despite the earnings decline, the company's stock price rose by 12% over the past month, aligning with broader market trends. Key factors could include the announcement of new REESE'S and OREO product innovations and the transition in leadership with Kirk Tanner taking over as CEO. Additionally, Hershey's revised sales growth guidance and ongoing dividend payouts may have influenced investor sentiment, amidst the backdrop of a generally upbeat market, buoyed by positive corporate earnings.

Hershey has 1 possible red flag we think you should know about.

Hershey's recent unveiling of its Q2 2025 earnings report, highlighting strong sales growth despite a decline in net income and earnings per share, has buoyed investor sentiment, as evident in its 12% monthly stock price rise. Over a more extended period, Hershey's total shareholder return, including share price and dividends, reached 44.71% over the past five years. This performance context shows a robust return for shareholders, despite the company underperforming the broader US market, which returned 17.5% in the last year, while outperforming the US Food industry, which returned -8% over the same period.

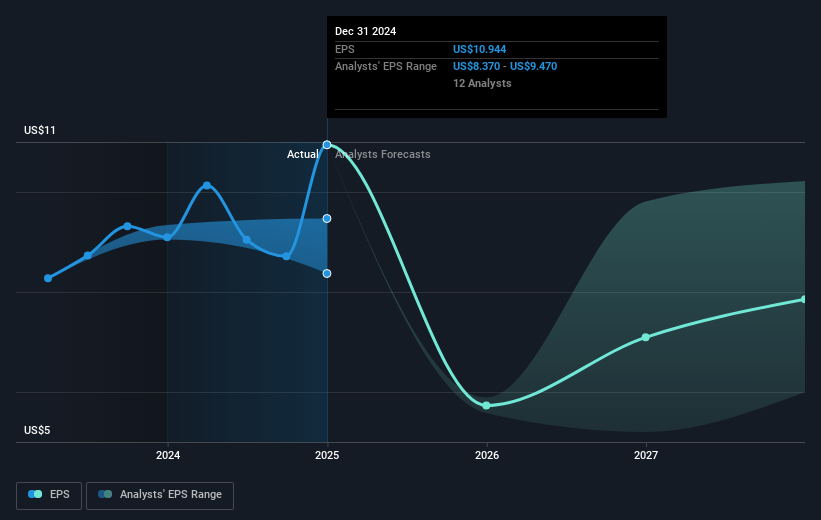

The leadership transition and product innovations mentioned may further enhance Hershey's revenue and earnings prospects by capturing additional market share and driving incremental revenue. Analysts expect Hershey's revenue to grow at 3.7% annually, slower than the broader US market's 9.1% annual growth. Earnings are forecasted to rise 6.47% per year, which may impact the company’s valuation, especially given the P/E ratio expectations from analysts. Hershey's stock presently trades at US$186.23, which is above the consensus analyst price target of US$166.43, indicating that the stock might be viewed as overvalued at this moment based on current expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives