- Netherlands

- /

- Biotech

- /

- ENXTAM:PHARM

Here's Why We Think Pharming Group (AMS:PHARM) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Pharming Group (AMS:PHARM). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Pharming Group

Pharming Group's Improving Profits

In the last three years Pharming Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Pharming Group's EPS soared from €0.041 to €0.058, over the last year. That's a impressive gain of 41%.

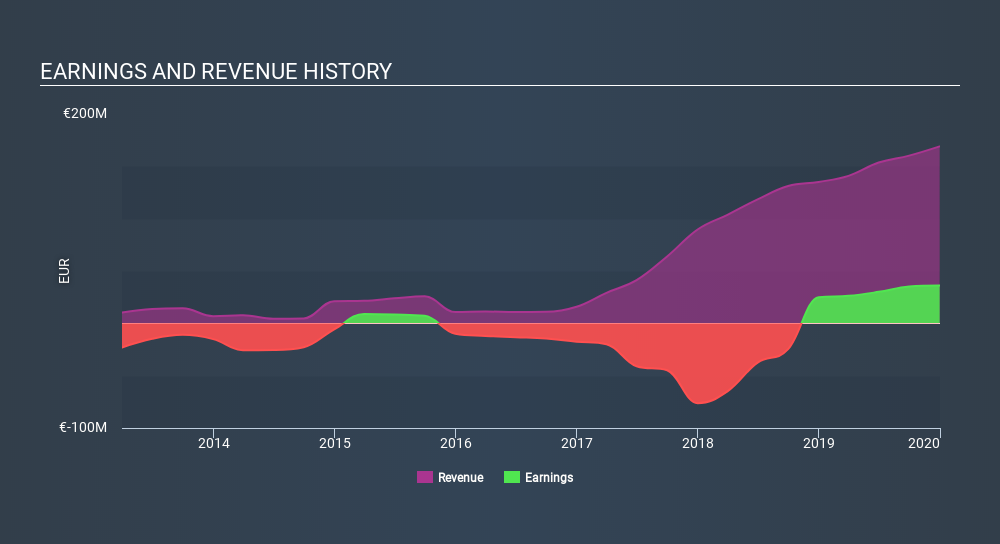

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Pharming Group shareholders can take confidence from the fact that EBIT margins are up from 28% to 36%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Pharming Group.

Are Pharming Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In the last year insider at Pharming Group were both selling and buying shares; but happily, as a group they spent €147k more on stock, than they netted from selling it. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. We also note that it was the Chief Medical Officer & Member of Management Board, Bruno M. Giannetti, who made the biggest single acquisition, paying €490k for shares at about €0.34 each.

Along with the insider buying, another encouraging sign for Pharming Group is that insiders, as a group, have a considerable shareholding. To be specific, they have €12m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Pharming Group Worth Keeping An Eye On?

You can't deny that Pharming Group has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Even so, be aware that Pharming Group is showing 3 warning signs in our investment analysis , you should know about...

As a growth investor I do like to see insider buying. But Pharming Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTAM:PHARM

Pharming Group

A biopharmaceutical company, develops and commercializes protein replacement therapies and precision medicines for the treatment of rare diseases in the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives