- Australia

- /

- Metals and Mining

- /

- ASX:CIA

Here's Why We Think Champion Iron (ASX:CIA) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Champion Iron (ASX:CIA). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Champion Iron

How Fast Is Champion Iron Growing Its Earnings Per Share?

In the last three years Champion Iron's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Champion Iron's EPS soared from CA$0.13 to CA$0.18, over the last year. That's a commendable gain of 42%. It also seems the company is in good financial health, since it has boosted EPS by buying back shares.

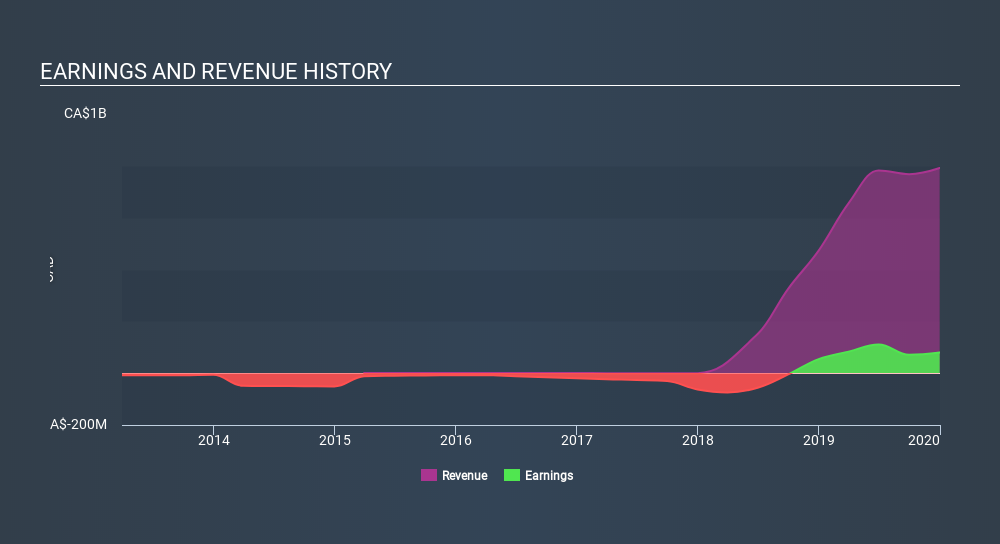

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Champion Iron is growing revenues, and EBIT margins improved by 11.6 percentage points to 45%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Champion Iron's forecast profits?

Are Champion Iron Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Champion Iron shares worth a considerable sum. Given insiders own a small fortune of shares, currently valued at CA$93m, they have plenty of motivation to push the business to succeed. That holding amounts to 11% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

Does Champion Iron Deserve A Spot On Your Watchlist?

For growth investors like me, Champion Iron's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. You should always think about risks though. Case in point, we've spotted 3 warning signs for Champion Iron you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:CIA

Champion Iron

Engages in the acquisition, exploration, development, and production of iron ore properties in Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives