- Australia

- /

- Infrastructure

- /

- ASX:TCL

Here's Why We Don't Think Transurban Group's (ASX:TCL) Statutory Earnings Reflect Its Underlying Earnings Potential

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Transurban Group's (ASX:TCL) statutory profits are a good guide to its underlying earnings.

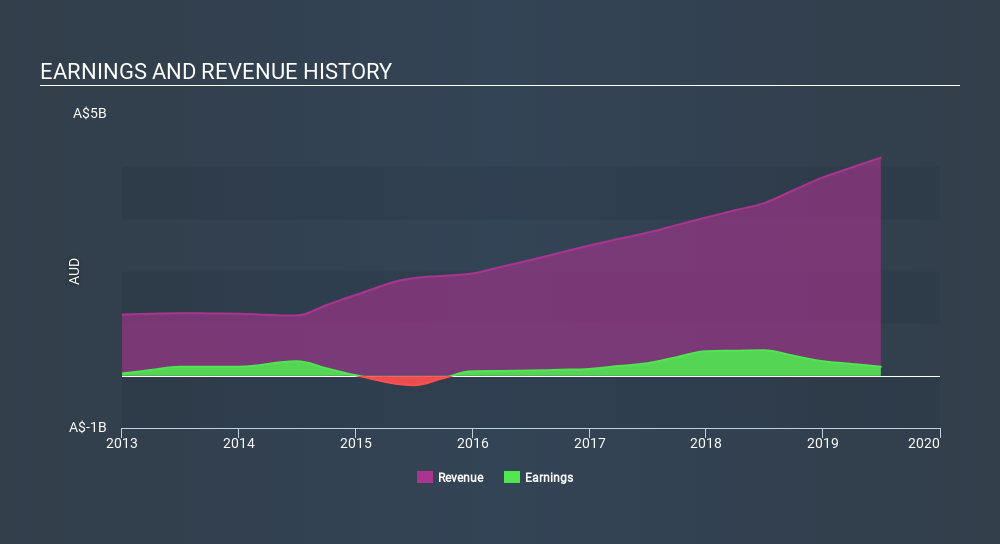

While Transurban Group was able to generate revenue of AU$4.17b in the last twelve months, we think its profit result of AU$171.0m was more important. In the chart below, you can see that its profit and revenue have both grown over the last three years, although its profit has slipped in the last twelve months.

See our latest analysis for Transurban Group

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. In this article we'll look at how Transurban Group is impacting shareholders by issuing new shares, as well as how unusual items have affected the income line. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Transurban Group issued 21% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Transurban Group's EPS by clicking here.

How Is Dilution Impacting Transurban Group's Earnings Per Share? (EPS)

Transurban Group has improved its profit over the last three years, with an annualized gain of 73% in that time. In comparison, earnings per share only gained 33% over the same period. Net profit actually dropped by 65% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 71%. So you can see that the dilution has had a bit of an impact on shareholders.Therefore, the dilution is having a noteworthy influence on shareholder returnsAnd so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Transurban Group's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Finally, we should also consider the fact that unusual items boosted Transurban Group's net profit by AU$203m over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. If Transurban Group doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Transurban Group's Profit Performance

To sum it all up, Transurban Group got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. For the reasons mentioned above, we think that a perfunctory glance at Transurban Group's statutory profits might make it look better than it really is on an underlying level. Ultimately, this article has formed an opinion based on historical data. However, it can also be great to think about what analysts are forecasting for the future. At Simply Wall St, we have analyst estimates which you can view by clicking here.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:TCL

Transurban Group

Engages in the development, operation, management, and maintenance of toll road networks.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives