- South Korea

- /

- Luxury

- /

- KOSDAQ:A267790

Here's Why We Don't Think Barrel's (KOSDAQ:267790) Statutory Earnings Reflect Its Underlying Earnings Potential

As a general rule, we think profitable companies are less risky than companies that lose money. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Barrel (KOSDAQ:267790).

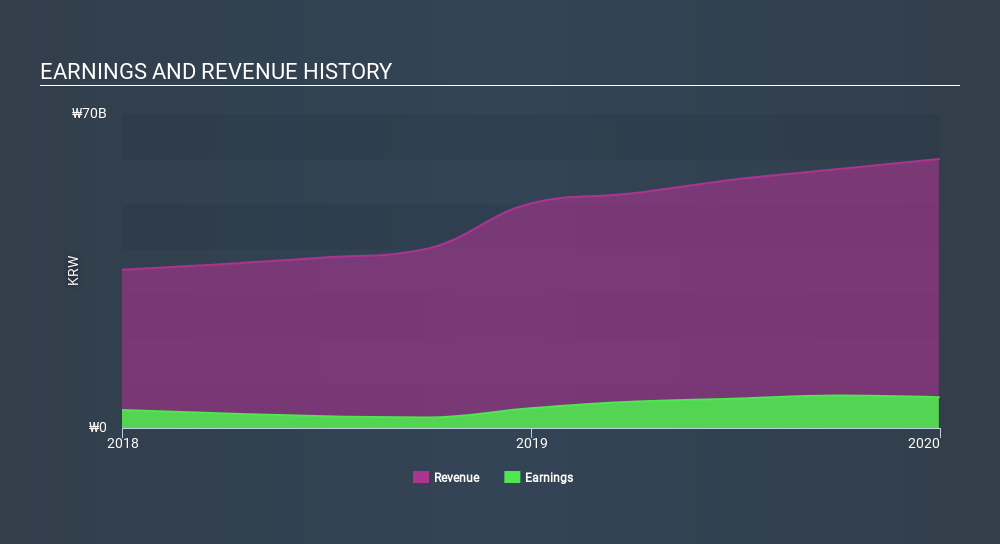

It's good to see that over the last twelve months Barrel made a profit of ₩6.88b on revenue of ₩59.9b.

Check out our latest analysis for Barrel

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. So today we'll examine what Barrel's cashflow and its expanding share count tell us about the nature of its profits. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Barrel.

Examining Cashflow Against Barrel's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Barrel has an accrual ratio of 0.54 for the year to December 2019. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. In the last twelve months it actually had negative free cash flow, with an outflow of ₩5.8b despite its profit of ₩6.88b, mentioned above. We also note that Barrel's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₩5.8b. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Barrel issued 8.3% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Barrel's historical EPS growth by clicking on this link.

A Look At The Impact Of Barrel's Dilution on Its Earnings Per Share (EPS).

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. The good news is that profit was up 57% in the last twelve months. On the other hand, earnings per share are only up 48% over the same period. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Barrel can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Barrel's Profit Performance

In conclusion, Barrel has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means its earnings per share growth is weaker than its profit growth. Considering all this we'd argue Barrel's profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. To that end, you should learn about the 4 warning signs we've spotted with Barrel (including 1 which shouldn't be ignored).

Our examination of Barrel has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KOSDAQ:A267790

Excellent balance sheet and good value.

Market Insights

Community Narratives