- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Here's Why We Don't Think Advanced Micro Devices's (NASDAQ:AMD) Statutory Earnings Reflect Its Underlying Earnings Potential

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Advanced Micro Devices (NASDAQ:AMD).

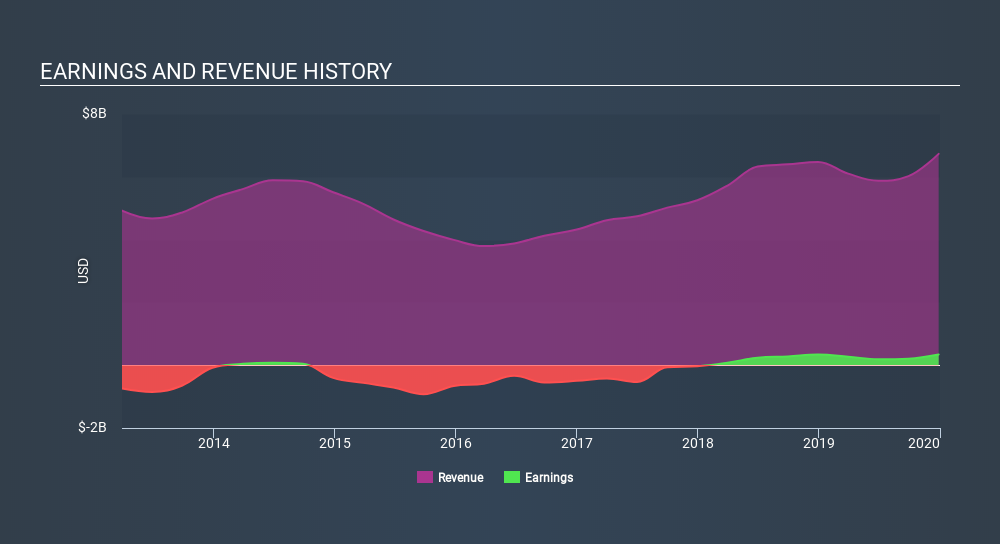

We like the fact that Advanced Micro Devices made a profit of US$341.0m on its revenue of US$6.73b, in the last year. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

Check out our latest analysis for Advanced Micro Devices

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. As a result, we'll today take a look at how dilution and cashflow shape our understanding of Advanced Micro Devices's earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Advanced Micro Devices's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Advanced Micro Devices has an accrual ratio of 0.23 for the year to December 2019. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had negative free cash flow of US$45m, in contrast to the aforementioned profit of US$341.0m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of US$45m, this year, indicates high risk. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Advanced Micro Devices increased the number of shares on issue by 11% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Advanced Micro Devices's EPS by clicking here.

How Is Dilution Impacting Advanced Micro Devices's Earnings Per Share? (EPS)

Advanced Micro Devices was losing money three years ago. But over the last year profit has held pretty steady. But EPS was considerably worse, since it declined 8.8% in that time. So you can see that the dilution has had a bit of an impact on shareholders.Therefore, the dilution is having a noteworthy influence on shareholder returnsAnd so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Advanced Micro Devices's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Advanced Micro Devices's Profit Performance

As it turns out, Advanced Micro Devices couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). For the reasons mentioned above, we think that a perfunctory glance at Advanced Micro Devices's statutory profits might make it look better than it really is on an underlying level. Obviously, we love to consider the historical data to inform our opinion of a company. But it can be really valuable to consider what other analysts are forecasting. At Simply Wall St, we have analyst estimates which you can view by clicking here.

Our examination of Advanced Micro Devices has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:AMD

Advanced Micro Devices

Operates as a semiconductor company internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Safaricom: Why I'm Holding Long

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.