Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Thales S.A. (EPA:HO) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Thales

What Is Thales's Debt?

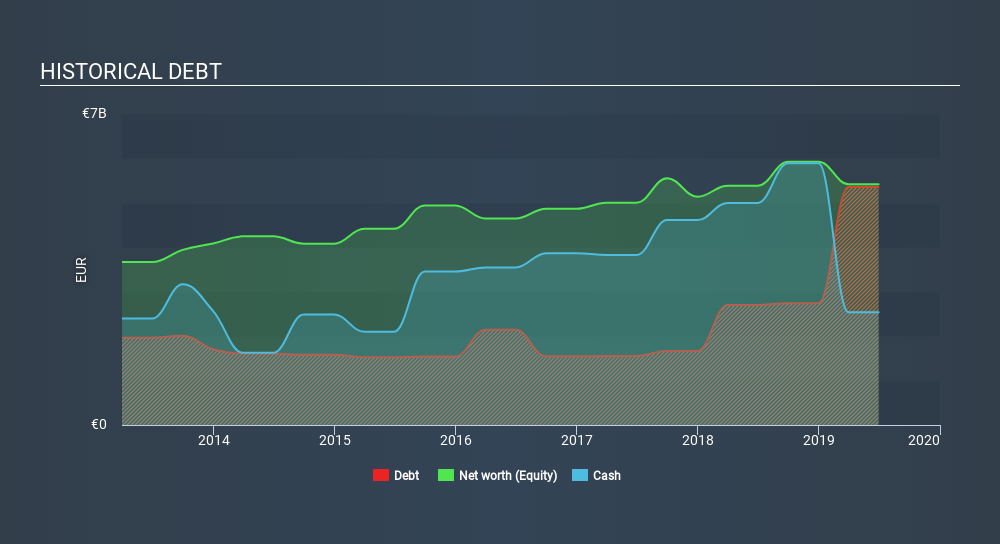

The image below, which you can click on for greater detail, shows that at June 2019 Thales had debt of €5.36b, up from €2.7k in one year. However, because it has a cash reserve of €2.54b, its net debt is less, at about €2.82b.

How Healthy Is Thales's Balance Sheet?

According to the last reported balance sheet, Thales had liabilities of €17.5b due within 12 months, and liabilities of €7.95b due beyond 12 months. Offsetting these obligations, it had cash of €2.54b as well as receivables valued at €8.67b due within 12 months. So it has liabilities totalling €14.2b more than its cash and near-term receivables, combined.

This is a mountain of leverage even relative to its gargantuan market capitalization of €20.5b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Thales's net debt to EBITDA ratio of about 1.5 suggests only moderate use of debt. And its commanding EBIT of 67.7 times its interest expense, implies the debt load is as light as a peacock feather. Thales's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Thales can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Thales produced sturdy free cash flow equating to 65% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

On our analysis Thales's interest cover should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For example, its level of total liabilities makes us a little nervous about its debt. Considering this range of data points, we think Thales is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Thales is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)