- United States

- /

- Trade Distributors

- /

- NYSE:SITE

Here's Why SiteOne Landscape Supply (NYSE:SITE) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies SiteOne Landscape Supply, Inc. (NYSE:SITE) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for SiteOne Landscape Supply

What Is SiteOne Landscape Supply's Debt?

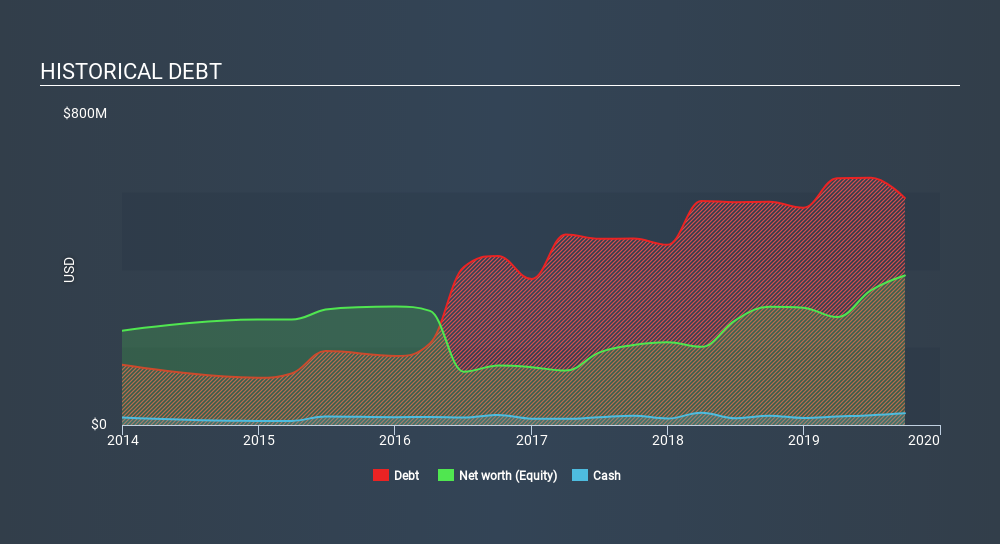

As you can see below, SiteOne Landscape Supply had US$583.7m of debt, at September 2019, which is about the same the year before. You can click the chart for greater detail. However, it does have US$30.3m in cash offsetting this, leading to net debt of about US$553.4m.

A Look At SiteOne Landscape Supply's Liabilities

Zooming in on the latest balance sheet data, we can see that SiteOne Landscape Supply had liabilities of US$359.0m due within 12 months and liabilities of US$783.5m due beyond that. Offsetting this, it had US$30.3m in cash and US$326.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$785.4m.

Since publicly traded SiteOne Landscape Supply shares are worth a total of US$4.16b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

SiteOne Landscape Supply's debt is 3.1 times its EBITDA, and its EBIT cover its interest expense 3.5 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. On a slightly more positive note, SiteOne Landscape Supply grew its EBIT at 14% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if SiteOne Landscape Supply can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, SiteOne Landscape Supply produced sturdy free cash flow equating to 51% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

On our analysis SiteOne Landscape Supply's EBIT growth rate should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to cover its interest expense with its EBIT. Considering this range of data points, we think SiteOne Landscape Supply is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for SiteOne Landscape Supply (1 is a bit unpleasant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:SITE

SiteOne Landscape Supply

Engages in the wholesale distribution of landscape supplies in the United States and Canada.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives