David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Reach Subsea ASA (OB:REACH) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Reach Subsea

How Much Debt Does Reach Subsea Carry?

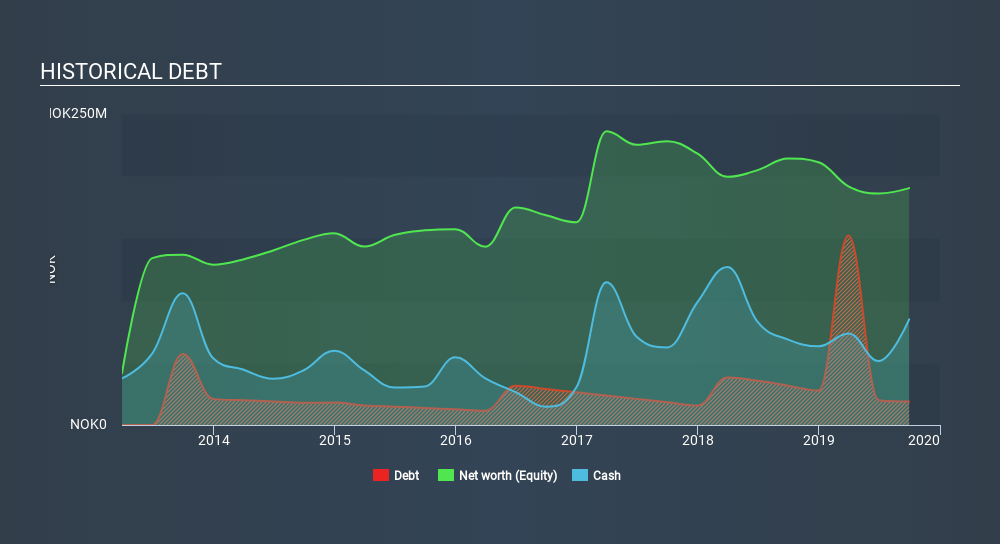

The image below, which you can click on for greater detail, shows that Reach Subsea had debt of kr18.8m at the end of September 2019, a reduction from kr31.6m over a year. However, its balance sheet shows it holds kr84.9m in cash, so it actually has kr66.1m net cash.

How Healthy Is Reach Subsea's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Reach Subsea had liabilities of kr233.1m due within 12 months and liabilities of kr97.1m due beyond that. Offsetting this, it had kr84.9m in cash and kr113.2m in receivables that were due within 12 months. So it has liabilities totalling kr132.1m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of kr197.4m. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry. While it does have liabilities worth noting, Reach Subsea also has more cash than debt, so we're pretty confident it can manage its debt safely.

Importantly, Reach Subsea's EBIT fell a jaw-dropping 25% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Reach Subsea will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Reach Subsea has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Reach Subsea actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

Although Reach Subsea's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of kr66.1m. And it impressed us with free cash flow of kr219m, being 1079% of its EBIT. So while Reach Subsea does not have a great balance sheet, it's certainly not too bad. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Reach Subsea (1 is a bit concerning) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OB:REACH

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives