- France

- /

- Healthcare Services

- /

- ENXTPA:EMEIS

Here's Why ORPEA Société Anonyme (EPA:ORP) Has A Meaningful Debt Burden

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that ORPEA Société Anonyme (EPA:ORP) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for ORPEA Société Anonyme

What Is ORPEA Société Anonyme's Net Debt?

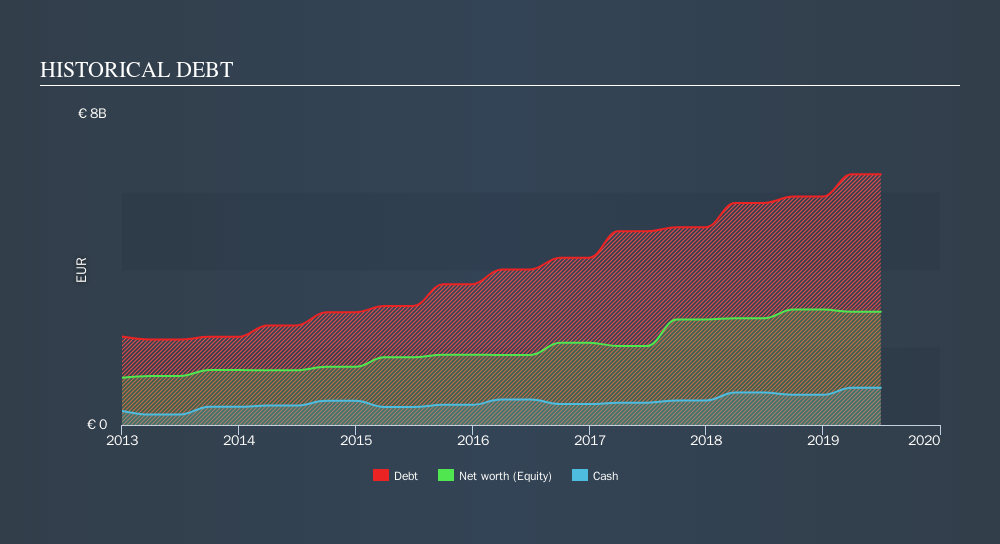

As you can see below, at the end of June 2019, ORPEA Société Anonyme had €6.45b of debt, up from €5.71b a year ago. Click the image for more detail. However, because it has a cash reserve of €955.3m, its net debt is less, at about €5.50b.

How Strong Is ORPEA Société Anonyme's Balance Sheet?

According to the last reported balance sheet, ORPEA Société Anonyme had liabilities of €2.20b due within 12 months, and liabilities of €9.21b due beyond 12 months. Offsetting this, it had €955.3m in cash and €881.1m in receivables that were due within 12 months. So its liabilities total €9.57b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's €6.88b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA ratio of 8.2, it's fair to say ORPEA Société Anonyme does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 3.2 times, suggesting it can responsibly service its obligations. However, one redeeming factor is that ORPEA Société Anonyme grew its EBIT at 15% over the last 12 months, boosting its ability to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ORPEA Société Anonyme can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, ORPEA Société Anonyme's free cash flow amounted to 44% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both ORPEA Société Anonyme's level of total liabilities and its track record of managing its debt, based on its EBITDA, make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. We should also note that Healthcare industry companies like ORPEA Société Anonyme commonly do use debt without problems. Looking at the bigger picture, it seems clear to us that ORPEA Société Anonyme's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. Over time, share prices tend to follow earnings per share, so if you're interested in ORPEA Société Anonyme, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:EMEIS

emeis Société anonyme

Operates nursing homes, assisted-living facilities, post-acute and rehabilitation hospitals, and psychiatric hospitals.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives