Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Optical Cable Corporation (NASDAQ:OCC) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Optical Cable

How Much Debt Does Optical Cable Carry?

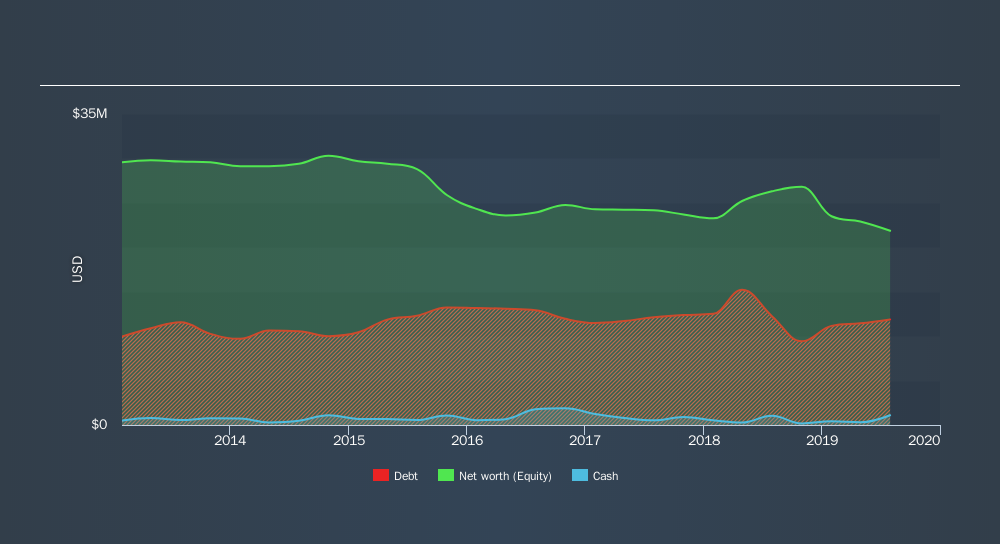

The chart below, which you can click on for greater detail, shows that Optical Cable had US$11.9m in debt in July 2019; about the same as the year before. However, because it has a cash reserve of US$1.10m, its net debt is less, at about US$10.8m.

How Healthy Is Optical Cable's Balance Sheet?

We can see from the most recent balance sheet that Optical Cable had liabilities of US$14.1m falling due within a year, and liabilities of US$5.53m due beyond that. Offsetting this, it had US$1.10m in cash and US$10.0m in receivables that were due within 12 months. So it has liabilities totalling US$8.56m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Optical Cable has a market capitalization of US$23.5m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But it is Optical Cable's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Optical Cable had negative earnings before interest and tax, and actually shrunk its revenue by 13%, to US$73m. We would much prefer see growth.

Caveat Emptor

Not only did Optical Cable's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping US$4.8m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of US$5.4m into a profit. In the meantime, we consider the stock very risky. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Optical Cable's profit, revenue, and operating cashflow have changed over the last few years.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:OCC

Optical Cable

Manufactures and sells fiber optic and copper data communications cabling and connectivity solutions primarily for the enterprise market in the United States and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives