- Australia

- /

- Specialized REITs

- /

- ASX:RFF

Here's Why I Think Rural Funds Group (ASX:RFF) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Rural Funds Group (ASX:RFF). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Rural Funds Group

Rural Funds Group's Earnings Per Share Are Growing.

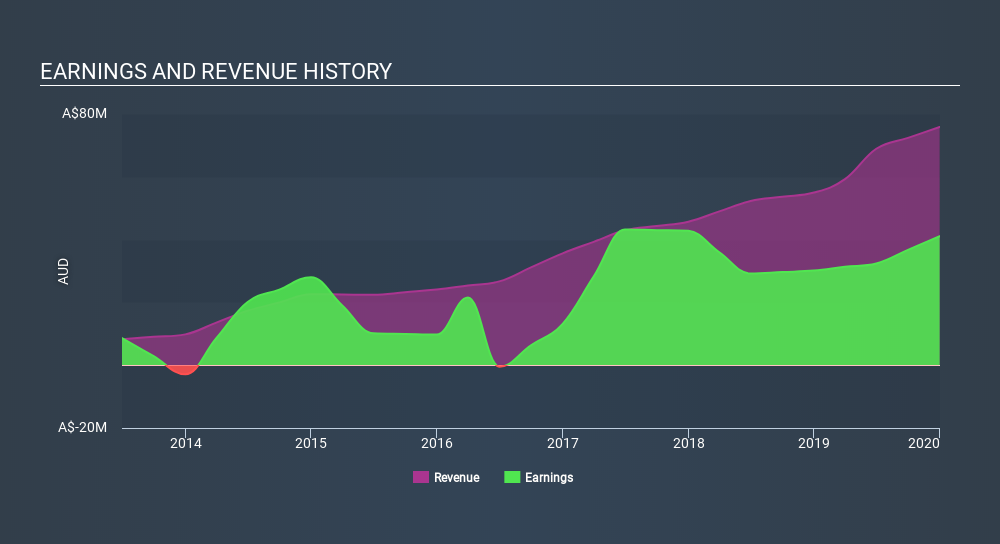

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Rural Funds Group has managed to grow EPS by 24% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Rural Funds Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Rural Funds Group shareholders can take confidence from the fact that EBIT margins are up from 64% to 72%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Rural Funds Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Rural Funds Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's a pleasure to note that insiders spent AU$2.7m buying Rural Funds Group shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Chairman of Rural Funds Management Limited Leslie Paynter for AU$699k worth of shares, at about AU$1.77 per share.

Does Rural Funds Group Deserve A Spot On Your Watchlist?

You can't deny that Rural Funds Group has grown its earnings per share at a very impressive rate. That's attractive. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Rural Funds Group is a strong candidate for your watchlist. Even so, be aware that Rural Funds Group is showing 3 warning signs in our investment analysis , and 1 of those is potentially serious...

The good news is that Rural Funds Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:RFF

Rural Funds Group

An agricultural Real Estate Investment Trust (REIT) listed on the ASX under the code RFF.

Very undervalued established dividend payer.

Market Insights

Community Narratives