Here's Why I Think Integrated Research (ASX:IRI) Is An Interesting Stock

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Integrated Research (ASX:IRI). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Integrated Research

How Fast Is Integrated Research Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Integrated Research has grown EPS by 11% per year. That growth rate is fairly good, assuming the company can keep it up.

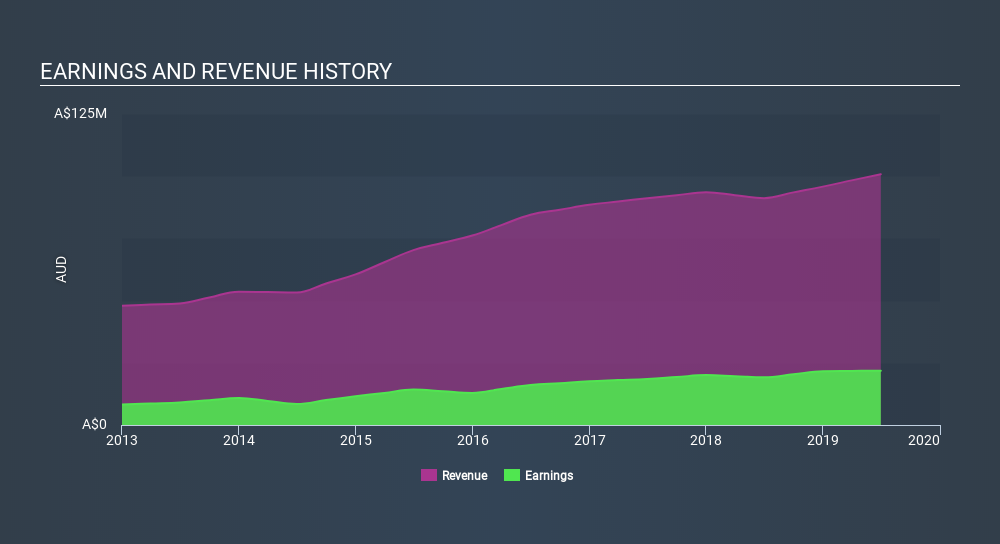

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Integrated Research's EBIT margins were flat over the last year, revenue grew by a solid 11% to AU$101m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Integrated Research's forecast profits?

Are Integrated Research Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Integrated Research insiders spent AU$117k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Independent Chairman, Paul Brandling, who made the biggest single acquisition, paying AU$60k for shares at about AU$2.38 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Integrated Research insiders own more than a third of the company. Actually, with 43% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about AU$236m riding on the stock, at current prices. That's nothing to sneeze at!

Should You Add Integrated Research To Your Watchlist?

As I already mentioned, Integrated Research is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Now, you could try to make up your mind on Integrated Research by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

As a growth investor I do like to see insider buying. But Integrated Research isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:IRI

Integrated Research

Designs, develops, implements, and sells systems and applications management computer software for business-critical computing, and unified communication and payment networks.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives