- United States

- /

- Mortgage REITs

- /

- NYSE:ACRE

Here's Why I Think Ares Commercial Real Estate (NYSE:ACRE) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Ares Commercial Real Estate (NYSE:ACRE). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Ares Commercial Real Estate

Ares Commercial Real Estate's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Ares Commercial Real Estate has grown EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

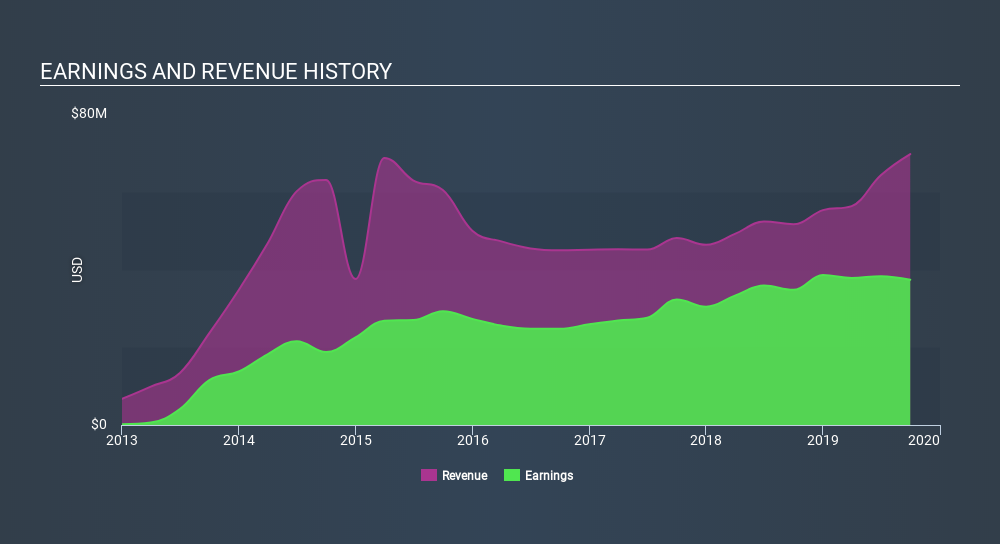

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Ares Commercial Real Estate's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Ares Commercial Real Estate maintained stable EBIT margins over the last year, all while growing revenue 35% to US$70m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Ares Commercial Real Estate's forecast profits?

Are Ares Commercial Real Estate Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders both bought and sold Ares Commercial Real Estate shares in the last year, but the good news is they spent US$6.3k more buying than they netted selling. So, on balance, the insider transactions are mildly encouraging. We also note that it was the Independent Director, Rand April, who made the biggest single acquisition, paying US$150k for shares at about US$15.42 each.

It's me that Ares Commercial Real Estate insiders are buying the stock, but that's not the only reason to think leader are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations between US$200m and US$800m, like Ares Commercial Real Estate, the median CEO pay is around US$1.7m.

The CEO of Ares Commercial Real Estate only received US$560k in total compensation for the year ending December 2018. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Ares Commercial Real Estate Deserve A Spot On Your Watchlist?

As I already mentioned, Ares Commercial Real Estate is a growing business, which is what I like to see. Like chocolate chips in vanilla ice cream, the insider buying, and modest CEO pay, make it better. The sum of all that, for me, points to a quality business, and a genuine prospect for further research. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Ares Commercial Real Estate. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Ares Commercial Real Estate, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ACRE

Ares Commercial Real Estate

A specialty finance company, engages in originating and investing in commercial real estate (CRE) loans and related investments in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives