- Canada

- /

- Trade Distributors

- /

- TSX:DBM

Here's Why CanWel Building Materials Group (TSE:CWX) Is Weighed Down By Its Debt Load

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, CanWel Building Materials Group Ltd. (TSE:CWX) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for CanWel Building Materials Group

What Is CanWel Building Materials Group's Debt?

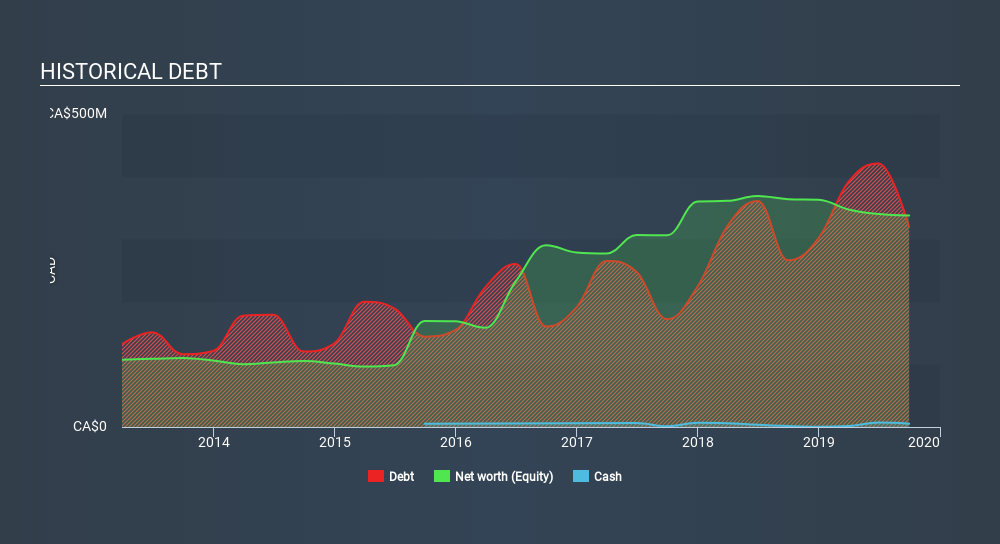

As you can see below, at the end of September 2019, CanWel Building Materials Group had CA$319.3m of debt, up from CA$266.2m a year ago. Click the image for more detail. And it doesn't have much cash, so its net debt is about the same.

How Strong Is CanWel Building Materials Group's Balance Sheet?

The latest balance sheet data shows that CanWel Building Materials Group had liabilities of CA$168.3m due within a year, and liabilities of CA$424.5m falling due after that. On the other hand, it had cash of CA$5.35m and CA$153.0m worth of receivables due within a year. So its liabilities total CA$434.5m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of CA$425.4m, we think shareholders really should watch CanWel Building Materials Group's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 2.0 times and a disturbingly high net debt to EBITDA ratio of 5.3 hit our confidence in CanWel Building Materials Group like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Another concern for investors might be that CanWel Building Materials Group's EBIT fell 19% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if CanWel Building Materials Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, CanWel Building Materials Group recorded free cash flow of 33% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both CanWel Building Materials Group's net debt to EBITDA and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least its conversion of EBIT to free cash flow is not so bad. Taking into account all the aforementioned factors, it looks like CanWel Building Materials Group has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for CanWel Building Materials Group (2 don't sit too well with us!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:DBM

Doman Building Materials Group

Through its subsidiaries, engages in the wholesale distribution of building materials and home renovation products in the United States and Canada.

Undervalued average dividend payer.

Market Insights

Community Narratives