- United States

- /

- Consumer Finance

- /

- NYSE:BFH

Here's Why Alliance Data Systems (NYSE:ADS) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Alliance Data Systems Corporation (NYSE:ADS) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Alliance Data Systems

How Much Debt Does Alliance Data Systems Carry?

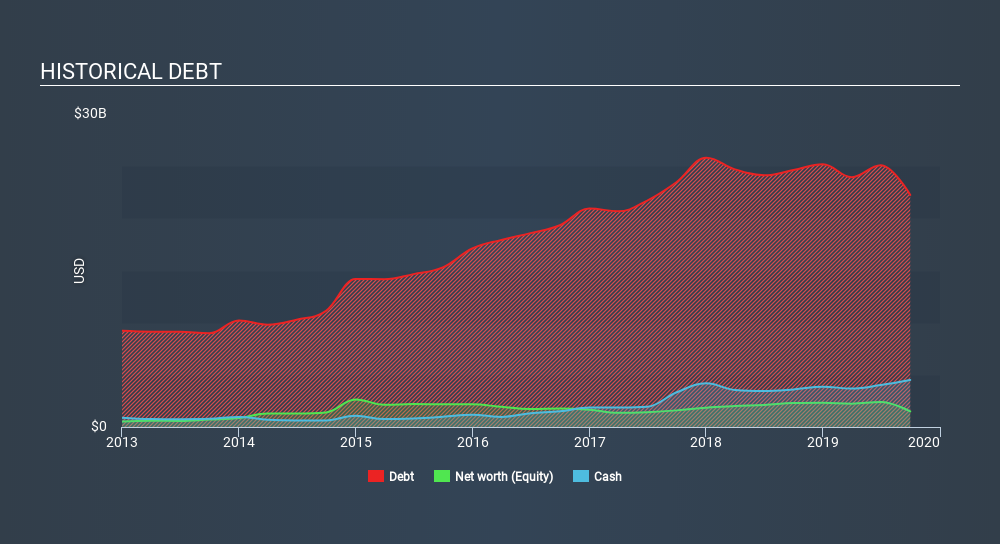

As you can see below, Alliance Data Systems had US$22.2b of debt at September 2019, down from US$24.6b a year prior. However, it does have US$4.51b in cash offsetting this, leading to net debt of about US$17.7b.

How Healthy Is Alliance Data Systems's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Alliance Data Systems had liabilities of US$11.8b due within 12 months and liabilities of US$13.8b due beyond that. On the other hand, it had cash of US$4.51b and US$450.8m worth of receivables due within a year. So it has liabilities totalling US$20.7b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$4.73b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Alliance Data Systems would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA ratio of 10.4, it's fair to say Alliance Data Systems does have a significant amount of debt. However, its interest coverage of 5.1 is reasonably strong, which is a good sign. We saw Alliance Data Systems grow its EBIT by 2.1% in the last twelve months. That's far from incredible but it is a good thing, when it comes to paying off debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Alliance Data Systems can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Alliance Data Systems actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Alliance Data Systems's net debt to EBITDA left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Alliance Data Systems stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Alliance Data Systems's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives