- United States

- /

- Banks

- /

- NasdaqCM:HVBC

Here's What We Think About HV Bancorp, Inc.'s (NASDAQ:HVBC) CEO Pay

Travis Thompson became the CEO of HV Bancorp, Inc. (NASDAQ:HVBC) in 2013. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for HV Bancorp

How Does Travis Thompson's Compensation Compare With Similar Sized Companies?

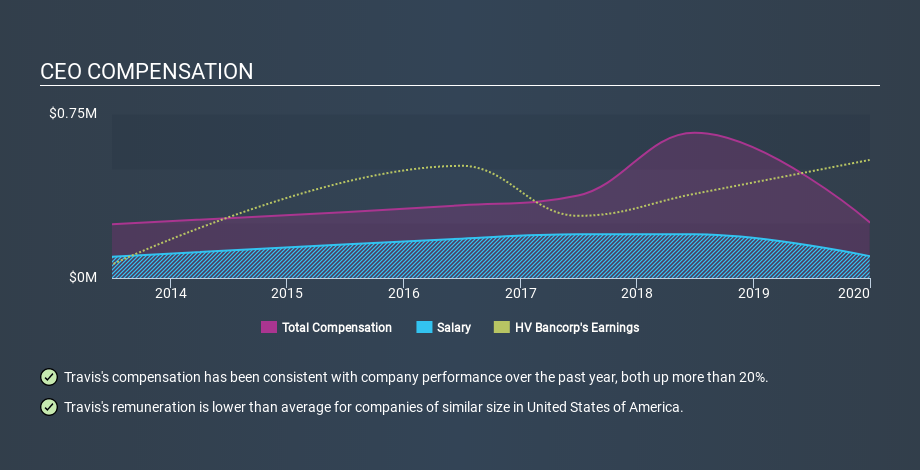

Our data indicates that HV Bancorp, Inc. is worth US$27m, and total annual CEO compensation was reported as US$255k for the year to December 2019. While we always look at total compensation first, we note that the salary component is less, at US$100k. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. We examined a group of similar sized companies, with market capitalizations of below US$200m. The median CEO total compensation in that group is US$595k.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of HV Bancorp. On a sector level, around 59% of total compensation represents salary and 41% is other remuneration. It's interesting to note that HV Bancorp allocates a smaller portion of compensation to salary in comparison to the broader industry.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. While this is a good thing, you'll need to understand the business better before you can form an opinion. You can see a visual representation of the CEO compensation at HV Bancorp, below.

Is HV Bancorp, Inc. Growing?

Over the last three years HV Bancorp, Inc. has seen earnings per share (EPS) move in a positive direction by an average of 10% per year (using a line of best fit). Its revenue is up 52% over last year.

This demonstrates that the company has been improving recently. A good result. The combination of strong revenue growth with medium-term earnings per share improvement certainly points to the kind of growth I like to see. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has HV Bancorp, Inc. Been A Good Investment?

Since shareholders would have lost about 11% over three years, some HV Bancorp, Inc. shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

It appears that HV Bancorp, Inc. remunerates its CEO below most similar sized companies.

Considering the underlying business is growing earnings, this would suggest the pay is modest. Unfortunately, some shareholders may be disappointed with their returns, given the company's performance over the last three years. We're not critical of the remuneration Travis Thompson receives, but it would be good to see improved returns to shareholders before the remuneration grows too much. This sort of circumstance certainly justifies further research, because the investment returns might still come in the future. CEO compensation is an important area to keep your eyes on, but we've also identified 4 warning signs for HV Bancorp (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqCM:HVBC

HV Bancorp

HV Bancorp, Inc. operates as the bank holding company for Huntingdon Valley Bank that provides various financial products and services to individuals and businesses.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives