- United States

- /

- Banks

- /

- NYSE:NTB

Here's What We Like About The Bank of N.T. Butterfield & Son Limited (NYSE:NTB)'s Upcoming Dividend

The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) is about to trade ex-dividend in the next 4 days. You can purchase shares before the 1st of November in order to receive the dividend, which the company will pay on the 15th of November.

Bank of N.T. Butterfield & Son's next dividend payment will be US$0.4 per share, on the back of last year when the company paid a total of US$1.8 to shareholders. Last year's total dividend payments show that Bank of N.T. Butterfield & Son has a trailing yield of 5.5% on the current share price of $32.02. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Bank of N.T. Butterfield & Son can afford its dividend, and if the dividend could grow.

See our latest analysis for Bank of N.T. Butterfield & Son

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Bank of N.T. Butterfield & Son paid out more than half (51%) of its earnings last year, which is a regular payout ratio for most companies.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's encouraging to see Bank of N.T. Butterfield & Son has grown its earnings rapidly, up 26% a year for the past five years.

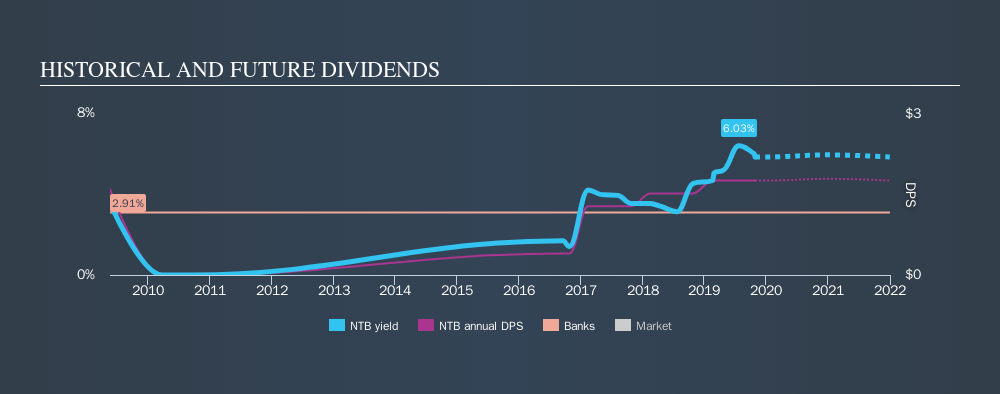

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last ten years, Bank of N.T. Butterfield & Son has lifted its dividend by approximately 1.0% a year on average. Earnings per share have been growing much quicker than dividends, potentially because Bank of N.T. Butterfield & Son is keeping back more of its profits to grow the business.

The Bottom Line

Should investors buy Bank of N.T. Butterfield & Son for the upcoming dividend? Bank of N.T. Butterfield & Son has an acceptable payout ratio and its earnings per share have been improving at a decent rate. In summary, Bank of N.T. Butterfield & Son appears to have some promise as a dividend stock, and we'd suggest taking a closer look at it.

Curious what other investors think of Bank of N.T. Butterfield & Son? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:NTB

Bank of N.T. Butterfield & Son

Provides a range of community, commercial, and private banking services to individuals and small to medium-sized businesses.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion